Coinbase Slips 7% Post-Earnings as Revenue Falls Short of Forecasts

Shares of Coinbase (COIN) dropped 7% in after-hours trading on Thursday after the company reported second-quarter financials that missed Wall Street expectations, despite year-over-year growth.

The crypto exchange generated $1.5 billion in revenue during Q2, up from $1.45 billion a year earlier but below analyst estimates of $1.59 billion, according to FactSet. Adjusted EBITDA came in at $512 million, down from $596 million in the same period last year.

Despite bitcoin (BTC) and ether (ETH) reaching new annual highs during the quarter, Coinbase experienced a quarter-over-quarter drop in trading activity. Transaction revenue came in at $764 million—a 39% decline from Q1—as trading volumes softened.

The weak results contrast with rival Robinhood’s (HOOD) upbeat Q2 report a day earlier, which saw $28.3 billion in crypto trading volume and exceeded analyst expectations. HOOD stock is up 160% year-to-date.

Coinbase continues to diversify beyond trading, emphasizing its role as a platform for both retail and institutional users. The company expanded services around custody for spot bitcoin ETFs, broadened its staking offerings, and made further headway with its Base layer-2 blockchain. However, trading remains the dominant revenue stream.

“In Q2, Coinbase took meaningful steps to bring the financial system onchain,” the company said in its earnings release, highlighting new product launches and broader global market reach.

More Stories

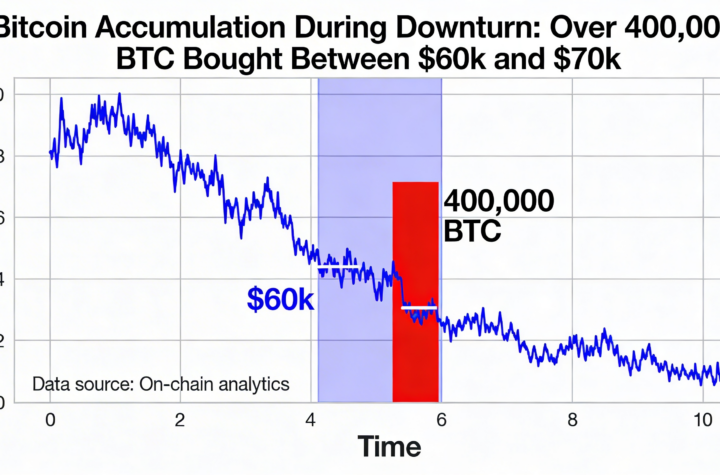

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

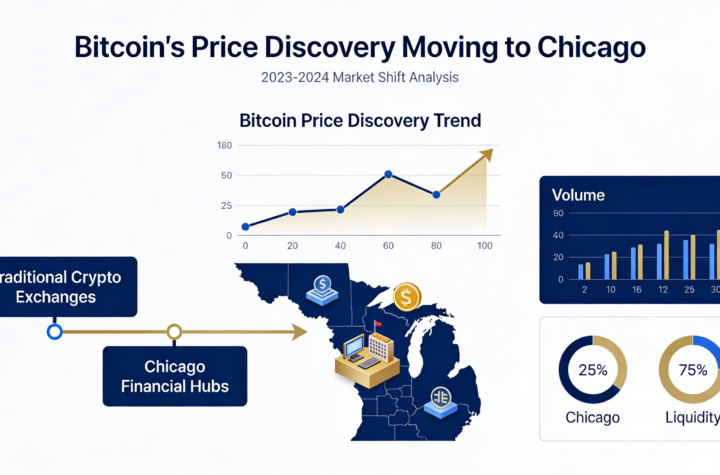

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago