Chainlink’s native token (LINK) experienced heightened volatility Thursday as institutional selling intensified, driving the token to its lowest price in over a week.

LINK fell 4% to a session low of $21.30, reversing more than 8% from Monday’s local high, according to CoinDesk data. The decline tracked broader market weakness, with the CoinDesk 20 Index falling by a similar margin.

Meanwhile, the Chainlink Reserve — a facility that purchases LINK using revenue from protocol integrations — continued its weekly support, buying 45,729 LINK worth nearly $1 million. The reserve now holds nearly $10 million in tokens, though Thursday’s drop pushed LINK below its average cost basis of $22.44.

Technical Snapshot

CoinDesk Research’s technical model signaled bearish momentum, reflecting declining investor sentiment. LINK’s trading range expanded to $1.05, indicating 5% intraday volatility between a low of $21.53 and a high of $22.68. Key resistance formed at $22.68, coinciding with exceptionally heavy trading volume of 1,981,247 units, with additional resistance noted at $21.92.

More Stories

According to Galaxy Digital’s research chief, Bitcoin faces a highly unpredictable 2026.

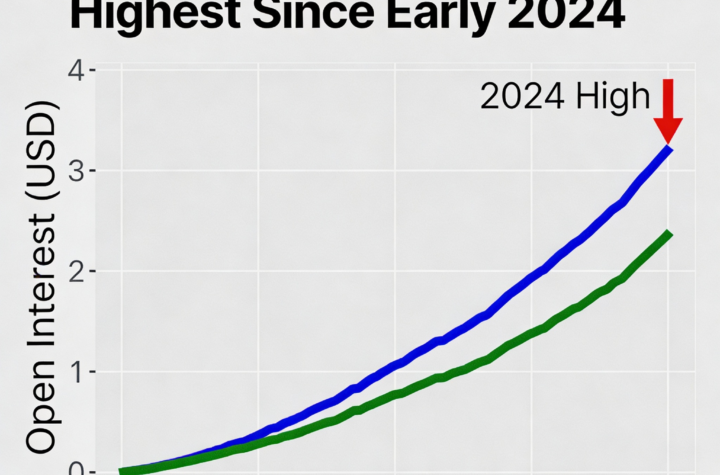

Bitcoin bullish bets on Bitfinex climb to a peak not seen since early 2024.

Bitcoin hovers near $89,000 while gold hits new highs and Asian equities rise.