Bitcoin Challenges Key Resistance as U.S. Inflation Data Looms

Bitcoin (BTC) rallied above $122,000 on Monday as investors eyed upcoming U.S. inflation figures and positioned for a potential Federal Reserve rate cut in September.

The world’s largest cryptocurrency touched $122,056, retesting the 1.618 Fibonacci extension level drawn from the 2018 and 2022 market lows—a key technical zone often referred to as the “golden ratio.” Widely regarded by technical analysts for its predictive value, the golden ratio is thought to reflect key psychological thresholds in market behavior.

This marks the second attempt in recent weeks by bulls to push above this resistance. A previous breakout in July proved short-lived, triggering a retreat below $112,000. A sustained move above this level could signal a breakout toward $140,000—currently the most popular options strike price on crypto derivatives exchange Deribit, with open interest exceeding $3 billion.

Failure to maintain momentum above $122K, however, would suggest weakening bullish strength and raise the likelihood of a corrective move.

At the time of writing, BTC was trading near $122,000, having hit an early-session high of $122,171, according to CoinDesk data.

Markets Eye U.S. CPI Report as Rate Cut Bets Build

Markets are now focused on the upcoming U.S. Consumer Price Index (CPI) report for July, due Tuesday. Economists expect core CPI—which excludes food and energy—to rise 0.3% month-over-month, up from 0.2% in June, reflecting the early effects of recently introduced tariffs.

A higher-than-expected print could temporarily unsettle markets but is unlikely to derail the Fed’s anticipated policy shift, said Marc Chandler, Chief Market Strategist at Bannockburn Global Forex.

“We expect the dollar’s downward trend to continue, even if inflation surprises slightly to the upside,” Chandler noted in a weekend market update. “The July jobs data significantly shifted rate expectations and ended the dollar’s short-term rebound.”

According to Chandler, with U.S. interest rates still at the lower end of their range and upcoming economic releases unlikely to reverse that, the risk asset rally—including crypto—may remain intact.

More Stories

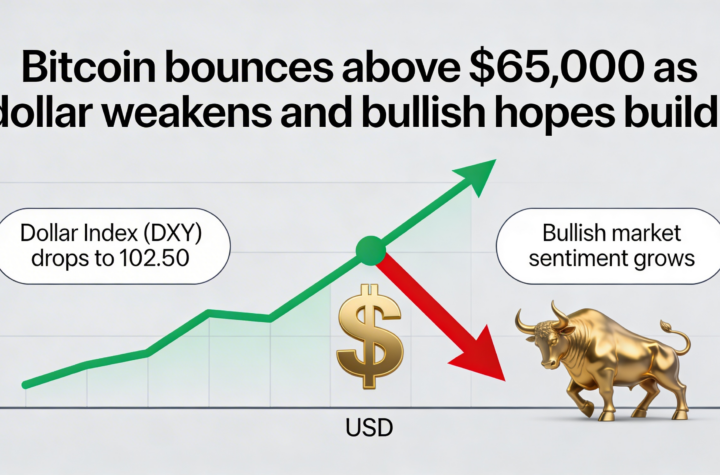

A firmer bounce lifts Bitcoin above $68,500, with Circle driving upside momentum across crypto stocks

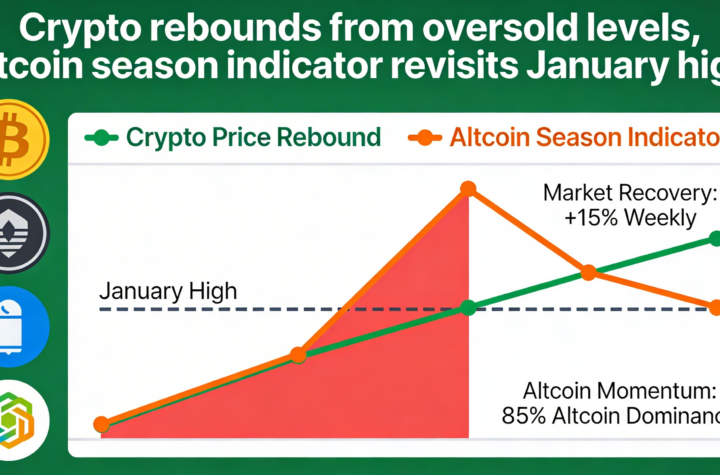

Crypto stages a rebound from technical lows while the altcoin season indicator revisits levels last seen in January.

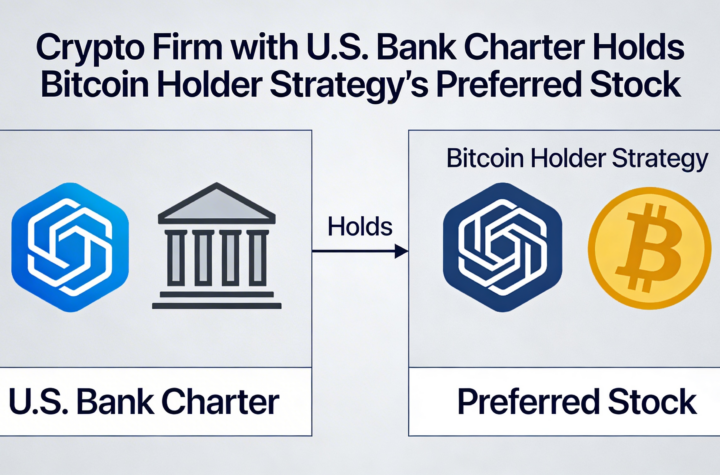

The U.S.-chartered crypto firm has taken a position in preferred stock from bitcoin treasury company Strategy.