The brief bitcoin rally triggered by trade war fears has quickly fizzled out, with prices falling once again.

By late afternoon in the U.S., bitcoin had dropped by 4.8%, reaching $96,900 after briefly spiking to $101,000 earlier in the day. Altcoins fared even worse, with solana (SOL), XRP, cardano (ADA), and chainlink (LINK) all dropping between 6% and 10%, while ether (ETH) saw a 5.3% decline.

The timing of the downturn coincided with a press conference featuring White House crypto and AI czar David Sacks, along with key Senate and House committee leaders. While the market had hoped for announcements regarding a potential U.S. bitcoin reserve, the discussion instead centered on regulatory issues, with only a brief mention of bitcoin. Sacks did confirm that the White House crypto working group is exploring the possibility of a bitcoin reserve, though no concrete details were provided.

At present, bitcoin appears to be gearing up for a possible retest of its recent low below $92,000. Friday’s U.S. employment report could provide the next major market catalyst, with a weak result potentially sparking speculation about Federal Reserve rate cuts, which could lift prices. On the other hand, a stronger report might reignite fears of rate hikes, posing a headwind for bitcoin and other cryptocurrencies.

More Stories

Silver plunges 35% and gold slides 12% amid a metals selloff, with bitcoin holding firm at $83,000.

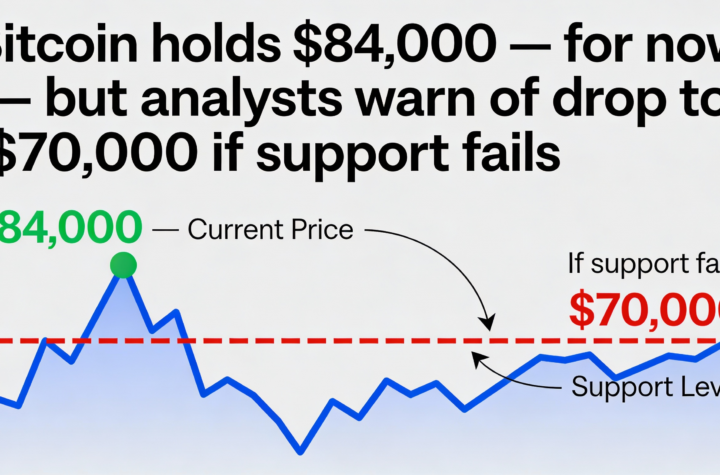

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

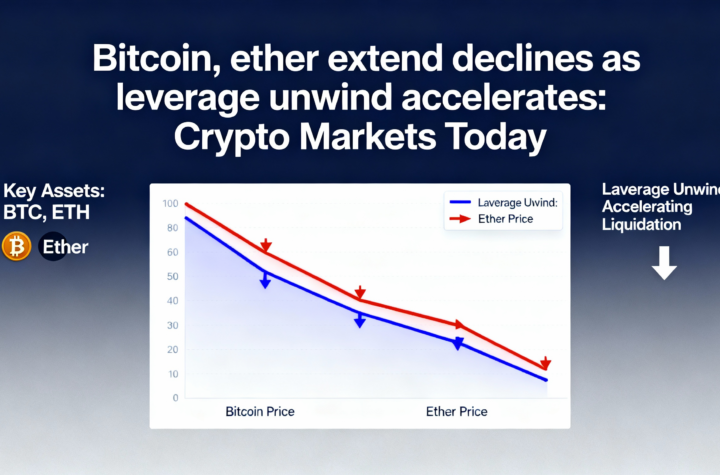

Crypto selloff intensifies as bitcoin and ether extend losses amid leverage unwind