Long-Term Bitcoin Holder Selling Eases, Solidifying $100K as a Key Support Level

The prolonged selling by Bitcoin (BTC) long-term holders appears to be winding down, helping to establish $100,000 as a crucial support level for the first time in the cryptocurrency’s history.

Since Jan. 17, Bitcoin has remained above $100,000 with just a brief dip, despite significant market volatility surrounding President Donald Trump’s inauguration, which added fuel to trading activity.

Long-term holders—investors who typically hold Bitcoin for more than 155 days—have been a major source of selling pressure in recent months. Often referred to as “smart money,” these holders are known for accumulating during price dips and selling during market strength, as highlighted in CoinDesk research.

In September, this group held 14.2 million BTC, but their holdings have since declined to 13.1 million BTC as of January. While their selling pace slowed earlier this year, recent price increases have triggered some renewed sales, though at a much lower intensity than seen in previous months.

Historically, selling activity from long-term holders tends to fade at critical points in Bitcoin’s price cycles, signaling market tops. This pattern has been observed during major peaks in 2013, 2017, 2021, and 2024.

The current behavior of long-term holders will be closely watched as traders assess whether Bitcoin’s consolidation above $100,000 is a precursor to further gains or an indication of a nearing cycle peak.

More Stories

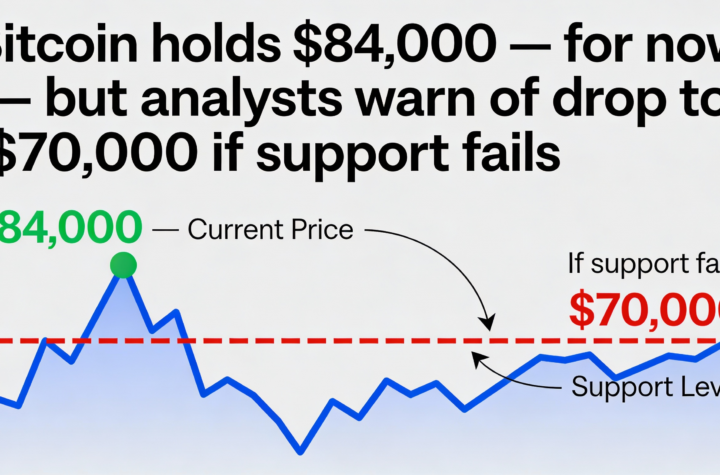

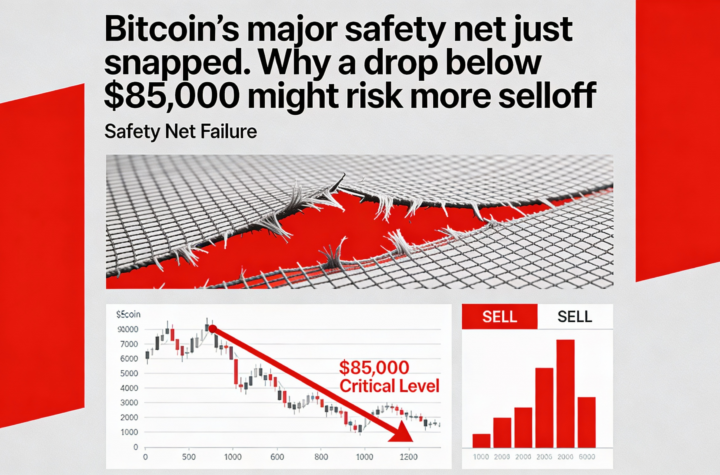

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

Crypto equities fall amid plunging spot volume and Bitcoin slipping under $84K

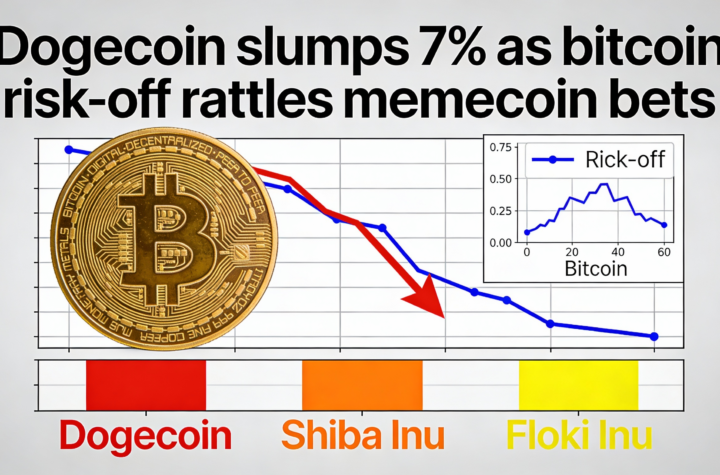

Dogecoin falls 7% as Bitcoin volatility spurs caution among memecoin traders.