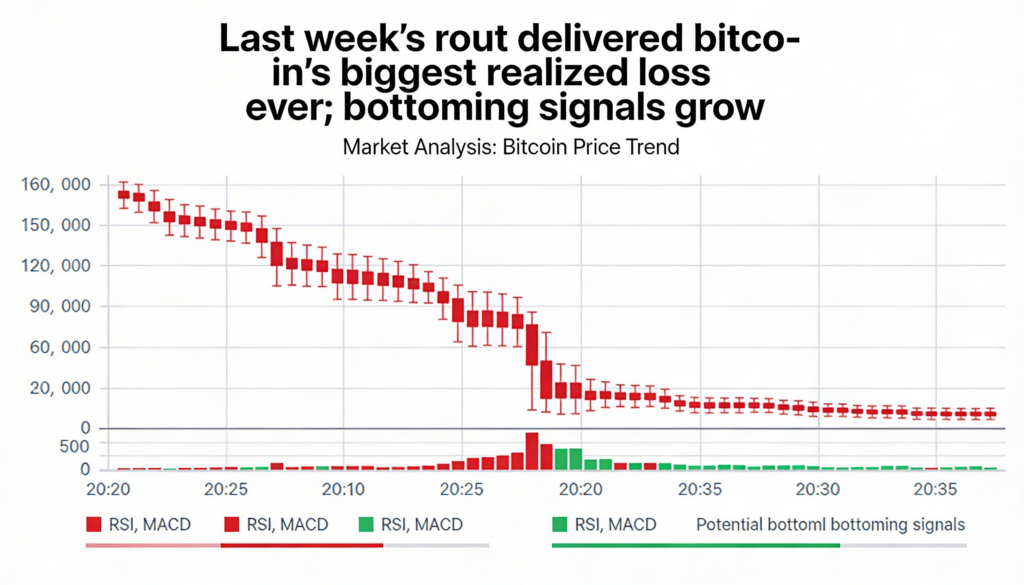

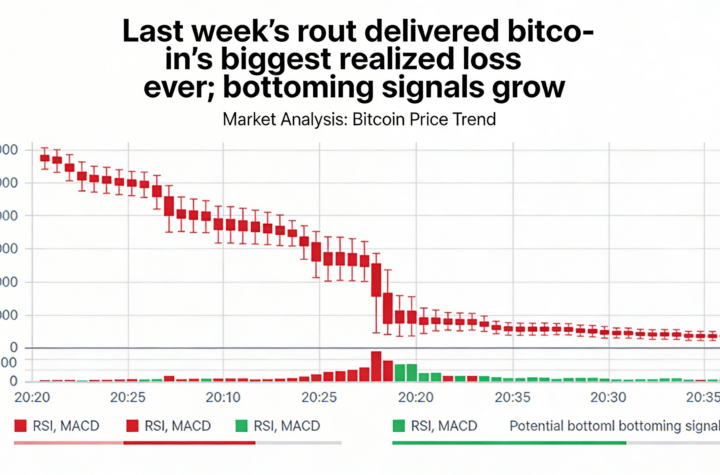

Bitcoin registered the largest realized loss in its history during last week’s sharp correction, as the price slid from $70,000 to $60,000 on Feb. 5.

According to on-chain data from Glassnode, Entity-Adjusted Realized Loss spiked to $3.2 billion. The metric captures the U.S. dollar value of coins sold below their acquisition cost, while filtering out transfers between wallets controlled by the same entity to avoid double counting.

The magnitude of the sell-off surpassed previous extremes, including the $2.7 billion in realized losses recorded during the 2022 collapse of Terra (LUNA), one of the most turbulent episodes in crypto market history.

Analytics firm Checkonchain described the move as a “textbook capitulation,” noting that the decline unfolded quickly, on heavy volume, and forced weaker hands to exit positions. Daily net realized losses topped $1.5 billion at the peak of the rout.

In absolute U.S. dollar terms, the event marks the largest loss ever crystallized on the Bitcoin network. Historically, episodes of this scale have coincided with late-stage bear market conditions and, at times, preceded the formation of price bottoms.

As of publication, Bitcoin was trading around $67,600, rebounding from last week’s lows.

More Stories

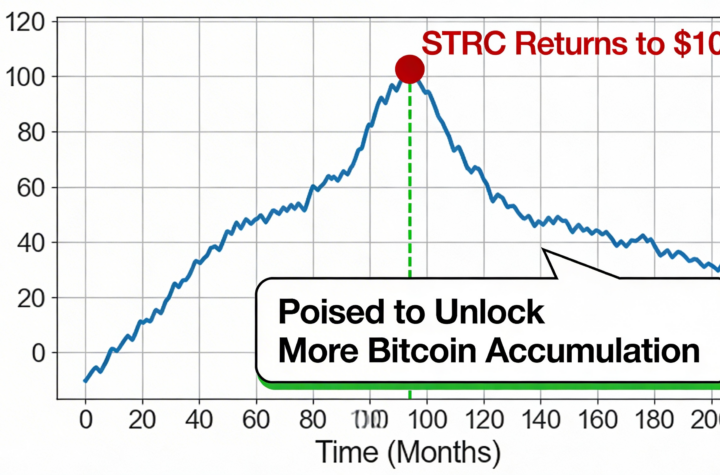

STRC returns to the $100 mark, positioning Strategy for further Bitcoin purchases.

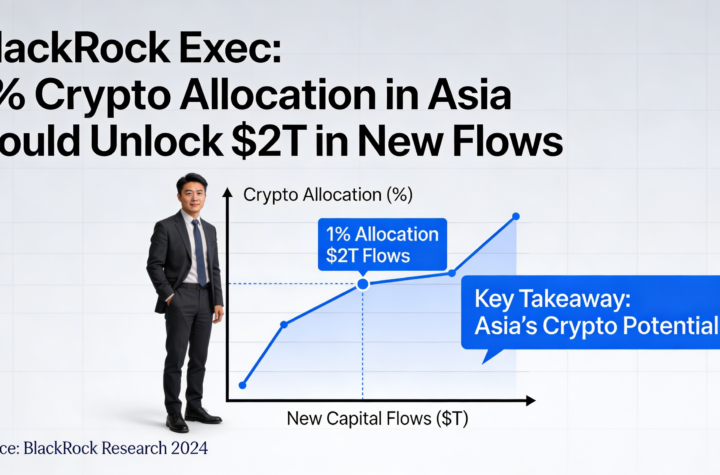

A 1% shift into crypto by Asian investors could generate $2 trillion in new capital, says a BlackRock exec.

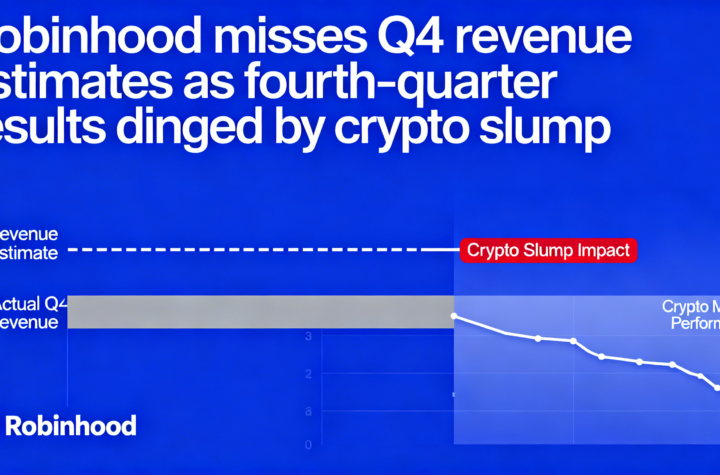

Robinhood falls short of Q4 revenue expectations as crypto downturn weighs on quarterly results.