Leveraged bullish positioning on Bitfinex is climbing sharply even as bitcoin continues to slide, pushing margin long exposure to levels not seen in nearly two years.

Margin longs on the exchange have risen to about 77,100 BTC, the highest since December 2023, when bitcoin was trading near $40,000, according to TradingView data. The increase comes as bitcoin dipped below $69,000 for the first time since November 2024.

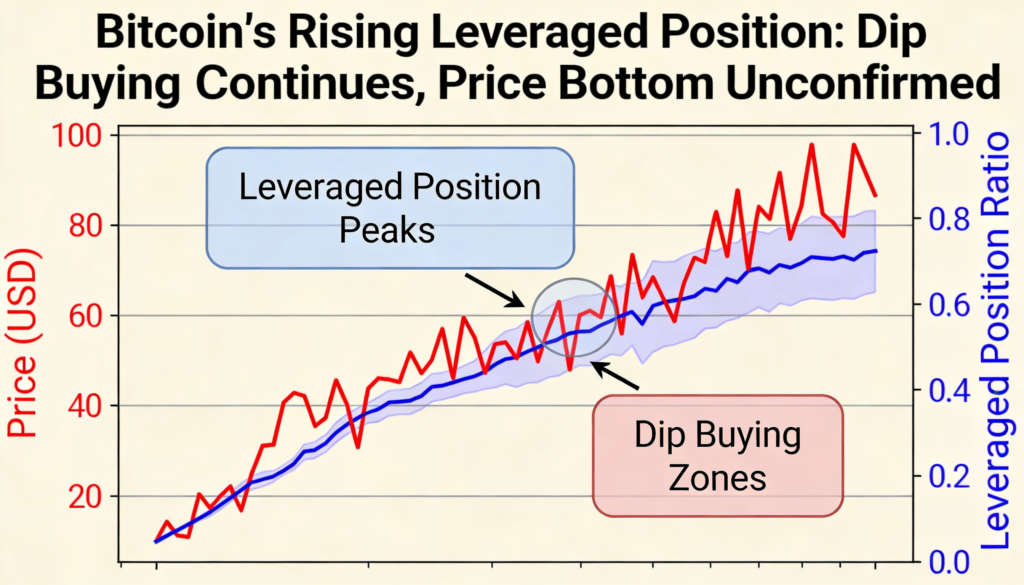

Over the past six months, margin long positions have expanded by roughly 64%, while bitcoin’s price has dropped nearly 50% from its October peak. The growing divergence suggests sustained accumulation during the downturn, potentially by a large holder steadily adding exposure.

Bitfinex margin long positioning has historically acted as a contrarian signal. Long exposure typically increases during periods of heightened market stress and declines once prices begin to recover.

At previous cycle lows, margin longs were elevated as prices stabilized and formed bottoms. Similar patterns were observed during the FTX collapse in November 2022, the August 2024 carry-trade unwind, and the “tariff tantrum” in April 2025.

The latest rise in leveraged longs coincides with bitcoin being on track for five consecutive monthly declines. While the buildup points to persistent dip buying, the continued increase in leveraged exposure may also suggest that the market has not yet reached a definitive price bottom.

More Stories

Bitcoin slips below $70,000 as crypto selloff intensifies ahead of the U.S. equity open.

Bitcoin rebounds above $71,000 as tech stock selloff eases.

Bhutan shifts bitcoin to trading firms and exchanges as BTC slides toward $70,000.