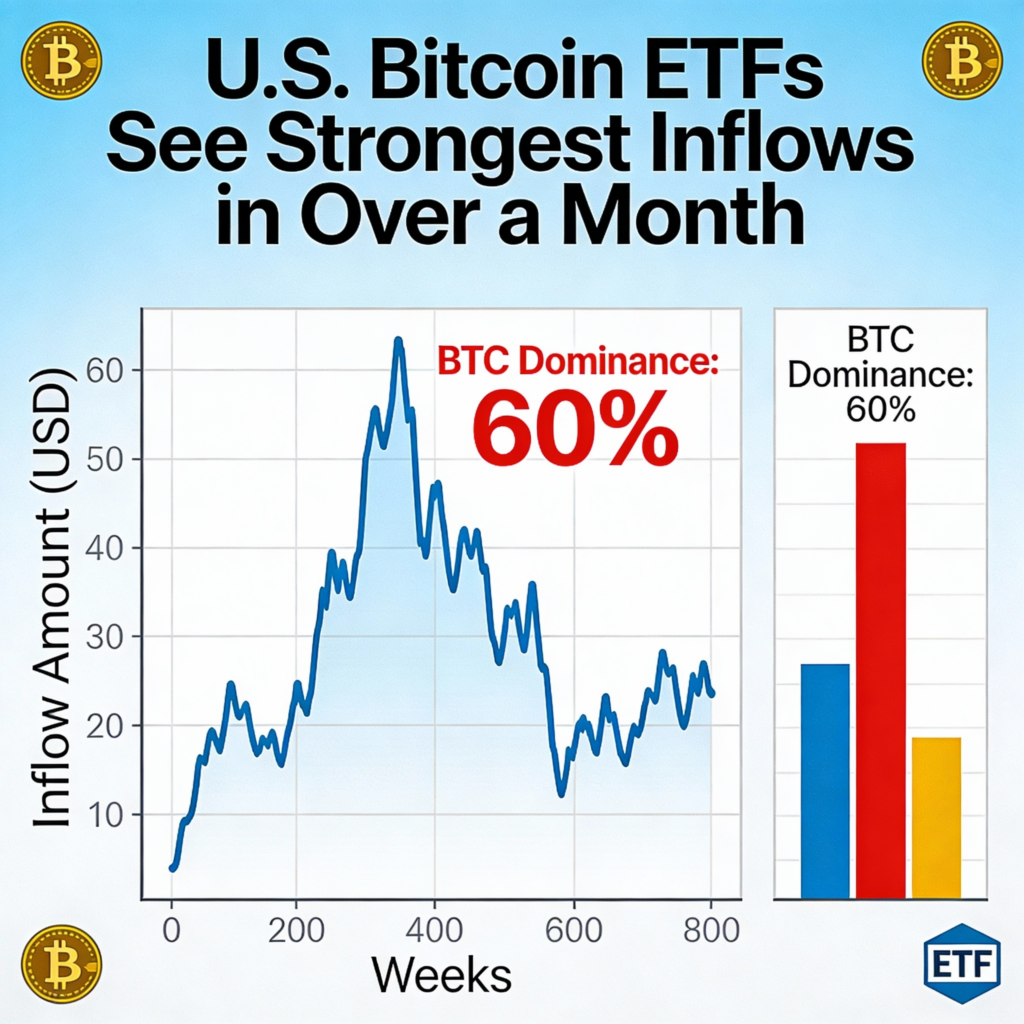

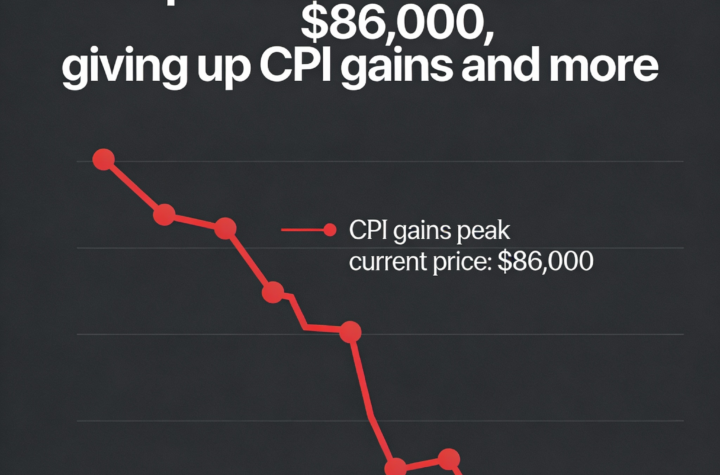

U.S. spot bitcoin ETFs recorded their largest one-day inflows since November 11 on Wednesday, as bitcoin (BTC) swung between nearly $90,000 and below $86,000 amid volatile market conditions.

Total net inflows reached $457.3 million, with $391.5 million going into the Fidelity Wise Origin Bitcoin Fund (FBTC), marking one of its top five inflow days, according to Farside data. BlackRock’s iShares Bitcoin Trust (IBIT) also saw strong demand, drawing $111.2 million.

Bitcoin dominance — the cryptocurrency’s share of total market capitalization — rose to 60%, the highest since November 14 when BTC was trading near $100,000. Currently, bitcoin is trading around $87,000.

Market volatility could be influenced further by upcoming macroeconomic events. The Volmex Bitcoin Implied Volatility Index (BVIV) shows implied volatility just below 50, historically low for the cryptocurrency despite recent swings.

Key events include the Bank of England, expected to cut rates by 25 basis points to 3.75%, and the European Central Bank, likely to maintain rates at 2.15%. Later, inflation data from both the U.S. and Japan may trigger additional market movements, potentially impacting cryptocurrencies.

More Stories

Bitcoin rises above $87,000 while the yen weakens after Japan raises interest rates.

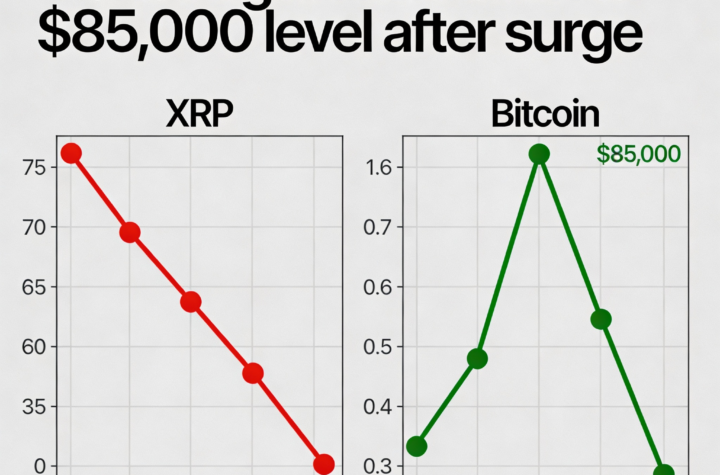

XRP falls alongside Bitcoin, which drops back to $85,000 after a surge.

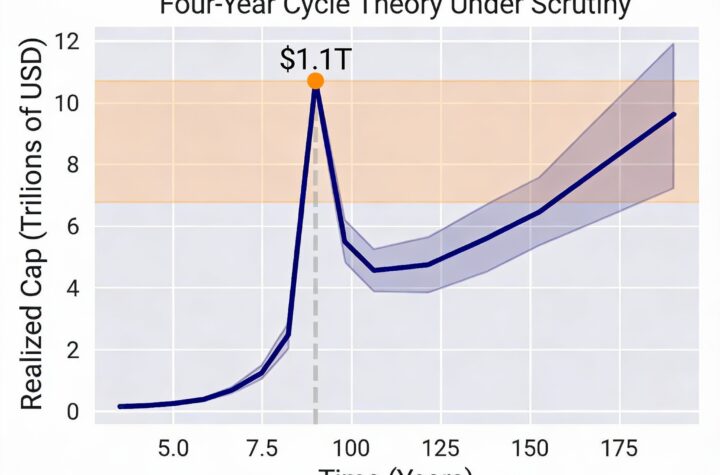

With Bitcoin’s realized cap staying at a record $1 trillion, the four-year market cycle comes under scrutiny.