Strategy’s Market Cap Soars to $128.5B as Bitcoin Holdings Drive Growth

Strategy (MSTR), the bitcoin-focused software company led by Michael Saylor, has hit a record $128.5 billion market capitalization, cementing its status as the largest corporate holder of bitcoin and one of the most aggressive equity issuers in U.S. markets.

The Tysons Corner-based firm has undergone a dramatic transformation since 2020, when it was worth under $2 billion. Today, it ranks as the 84th largest public company in the U.S., propelled by a multiyear shift toward bitcoin accumulation and strategic capital raises.

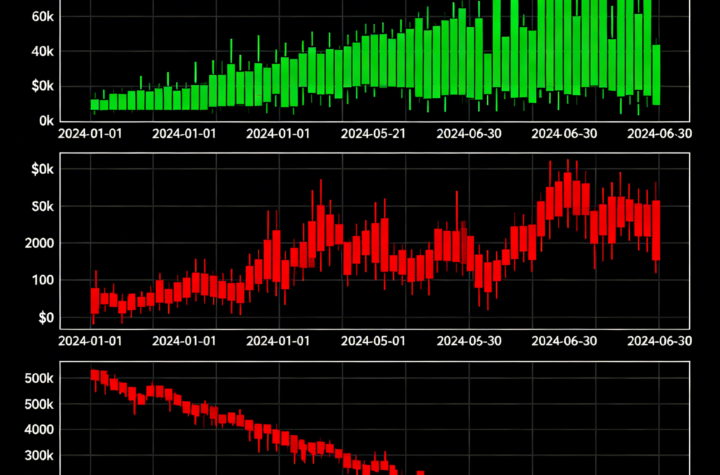

The number of shares outstanding has nearly tripled to 281.9 million since 2020, following a 10-for-1 stock split in August 2024 and the extensive use of at-the-market (ATM) equity programs. The figure includes all Class A and B shares as well as shares issued or pending through options, RSUs, and convertible notes.

In October, Strategy launched a $42 billion fundraising plan over three years, following a $21 billion raise in Q3 2024. Most of the capital has been used to expand its bitcoin treasury, which now holds 601,550 BTC worth more than $70 billion.

With this strategy, MSTR has effectively become a corporate bitcoin ETF-like vehicle, using equity and debt to offer high-leverage exposure to BTC.

Shares currently trade at $455.90, down 15% from the November 2024 high. Yet investor interest remains strong, with MSTR viewed as a liquid, high-volatility proxy for bitcoin exposure.

The company’s Assumed Diluted Shares Outstanding stands at 315.1 million, reflecting all potential dilution from convertible instruments and performance-related equity awards.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%