Bitcoin Stuck in Low-Liquidity ‘Air Gap’ Amid Ongoing Post-All-Time-High Correction

Bitcoin (BTC) is trading near $115,000 early Thursday in Asia, up about 1% in the past 24 hours, as the market continues to digest the recent all-time high (ATH) correction amid thin trading volumes.

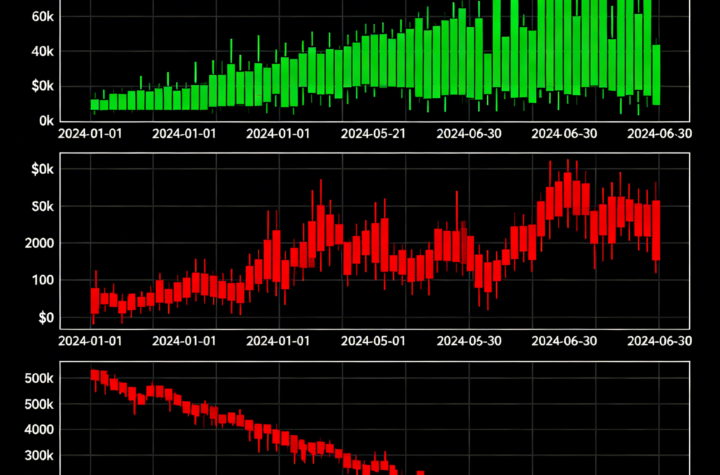

Glassnode data reveals BTC has entered a so-called “air gap” — a low-liquidity zone between $110,000 and $116,000 — after dropping below a key support cluster where short-term holders previously found stability.

Such low-volume zones can either become a platform for accumulation or a trap leading to further losses if buying interest doesn’t return.

“The market is essentially searching for solid footing,” Glassnode analysts noted, identifying the range from $110,000 (previous ATH) to $116,000 (recent buyer entry level) as a critical battleground.

While opportunistic buyers have acquired approximately 120,000 BTC during the dip, prices have yet to break convincingly above resistance, particularly near $116,900 — a key threshold tied to short-term holder activity.

Short-term holder profitability has declined from 100% to roughly 70%, typical of a mid-bull market phase. However, without fresh inflows, investor sentiment may weaken rapidly. Bitcoin ETF flows have turned negative with a 1,500 BTC outflow this week—the largest since April. Meanwhile, derivative market funding rates have eased, signaling cautious trader behavior.

Market maker Enflux described the environment as fragile: “Despite some relief in altcoins, major coins like BTC and ETH are struggling to build confidence. Volume remains light, and the broader trend looks weak.”

Ethereum (ETH) gained 2% over 24 hours, trading just below $3,600. The CoinDesk 20 Index, tracking a broad range of crypto assets, rose 1.69% to 3,815.22.

Enflux added, “Until BTC and ETH regain momentum with stronger volume, sideways or downward moves seem likely.”

The next market move depends on whether buyers step in to establish a base in this low-liquidity zone or if prices must fall back to $110,000 to reset the trend. Traders remain cautious, and bulls have yet to prove their strength.

Market Highlights:

- Bitcoin: Analysts warn of a potential supply squeeze as OTC desk reserves dry up and corporate buying remains steady, possibly igniting price movement after BTC dips below $110K.

- Ethereum: ETH may have peaked locally amid heavy sell pressure ($419 million, second highest on record) as it tests resistance near $4,000 — a level that previously preceded a 66% crash in late 2024. This raises the risk of a 25–35% decline by September. Polymarket bettors remain split, with 48% betting on a rally to $5,000 despite bearish indicators.

- Gold: Gold’s recent rally paused as traders took profits and factored in rising expectations of Federal Reserve rate cuts, ongoing U.S. trade tensions, and possible Fed leadership changes. Spot gold traded at $3,372.11, down 0.24%.

- Nikkei 225: Asia-Pacific markets opened mixed Thursday; Japan’s Nikkei 225 was flat as investors brushed off new U.S. semiconductor tariff threats.

- S&P 500: U.S. futures were steady Wednesday night amid reactions to new semiconductor tariffs. The S&P 500 remains up 1.7% for the week.

More Stories

Cryptocurrencies and equities rally further as Donald Trump suggests the Iran conflict could wrap up soon.

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin may emerge as the biggest beneficiary if the U.S.–Iran conflict stretches on for months.