Crypto Sentiment Deteriorates as Traders Lock in Profits, Brace for Macro Risks

After a stretch of all-time highs, sentiment across digital asset markets has cooled sharply, with traders once again confronting a challenging macroeconomic backdrop.

Bitcoin (BTC) and ether (ETH) retreated over the past 24 hours, as profit-taking set in and mounting leverage heightened pressure across major tokens. Bitcoin fell more than 1.5% to $113,500, slipping below critical trendlines that had underpinned its recent rally.

“Bitcoin dropped to $114,700, revisiting levels from two weeks ago and breaching its 50-day moving average,” said Alex Kuptsikevich, chief market analyst at FxPro. “This supports fears of a broader market correction, with a potential decline toward $100,000—near the 200-day MA.”

The total crypto market cap fell 0.4% to $3.87 trillion, raising concerns that a broader correction could target the $3.6 trillion mark, Kuptsikevich added.

Ether dropped 1.8% to $4,159, now down over 12% from its recent peak, as it tests the $4,100 support level—previously a ceiling during multiple rallies since March.

Losses extended across the altcoin space:

- XRP fell 4.1% to $2.89

- Dogecoin (DOGE) shed 2.4% to $0.218

- Cardano (ADA) led losses with a 6.6% drop

Macro Uncertainty Returns to Center Stage

Investor mood has turned defensive as stronger-than-expected U.S. inflation data dims hopes for imminent rate cuts. This macro shift has prompted profit-taking, particularly among short-term holders.

“Bitcoin is undergoing a minor correction after reaching record highs last week,” said Joel Kruger, market strategist at LMAX Group. “The upside surprise in inflation data has tempered expectations for near-term Fed rate cuts, dragging sentiment lower.”

Ether has followed a similar path, retracing gains as leveraged long positions unwind. Still, institutional inflows into Ethereum products remain robust, lending support to the medium-term outlook.

“ETH is mirroring Bitcoin’s retracement, but ETF flows and rising treasury allocations continue to demonstrate institutional conviction,” Kruger added.

Leverage Adds to Volatility

The build-up in leverage across crypto derivatives is adding to short-term instability. According to Ryan Lee, chief analyst at Bitget, open interest in futures markets has hit record highs.

“This level of leverage can amplify both rallies and declines,” Lee said. “It makes both BTC and ETH more vulnerable to sharp price moves triggered by any shift in sentiment.”

All Eyes on Jackson Hole

Traders are now focused on the upcoming speech from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium, where he’s expected to signal the central bank’s policy trajectory heading into autumn. The remarks could impact not just crypto, but also equity and currency markets.

More Stories

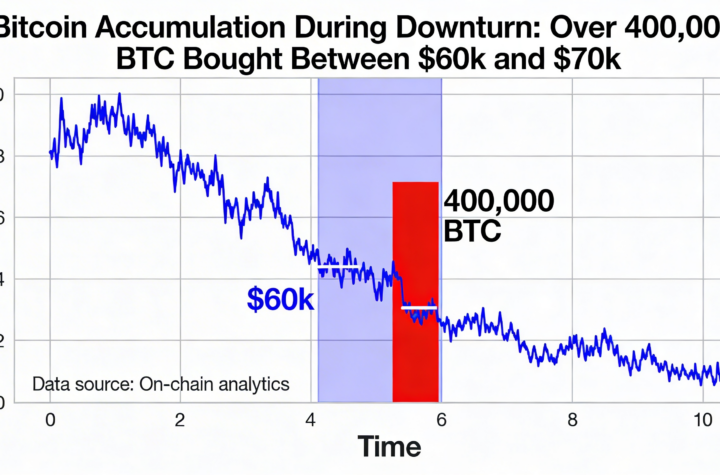

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

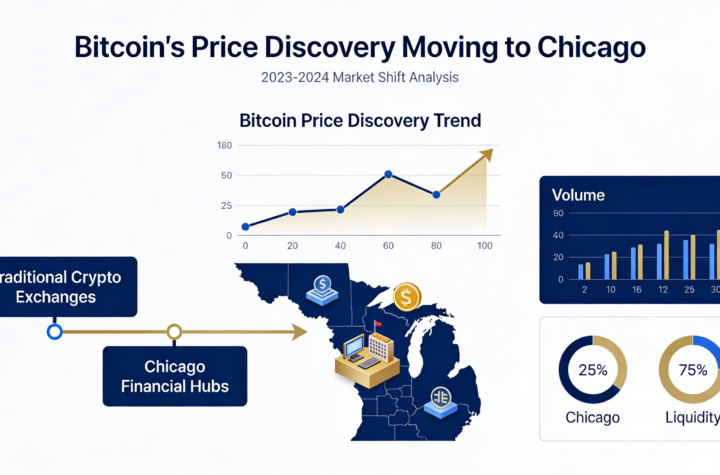

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago