AAVE Bounces Back From 15% Decline as DeFi Yield Markets Gain Strength

Despite challenging global economic conditions, AAVE has shown strong resilience, recovering from a 15% drop over the past four days as interest in DeFi yield products continues to accelerate.

The protocol’s price climbed from a low near $240 to above $250, fueled by growing demand for tokenized yield markets, which are attracting more institutional and retail participants.

This recovery comes amid renewed volatility sparked by escalating U.S.-China trade tensions and reports of alleged trade agreement violations, which have unsettled broader risk assets.

The DeFi sector is demonstrating renewed vigor, with total value locked (TVL) climbing to $178.52 billion. AAVE remains a dominant player with a TVL of $25.41 billion, underscoring its leadership in decentralized lending.

Key Catalysts

AAVE’s recent strength is tied to its collaboration with Pendle, whose tokenized yield markets quickly reached capacity upon launch, reflecting strong market appetite for yield-generating instruments.

The Ethereum Foundation’s recent $2 million borrowing of Aave’s decentralized stablecoin GHO — backed by ETH collateral — highlights strategic asset utilization within the ecosystem.

GHO loans are fully overcollateralized, and interest payments support the Aave DAO treasury, promoting a sustainable, community-driven governance model.

Market data from IntoTheBlock indicates Aave holds a 45% share of the decentralized lending market from early 2023 to mid-2025, confirming its recovery and ongoing dominance after the 2023 DeFi slowdown.

Technical Highlights

AAVE formed robust support around $242.70 during high-volume trading sessions, attracting strong buying interest.

An ascending triangle pattern with rising lows suggests accumulation and potential bullish momentum despite resistance near $253.75.

After reaching a peak near $256, the price consolidated around $248-$250.

Volume spikes corresponded with quick price jumps, establishing new resistance levels and a cup-and-handle pattern — a classic bullish continuation formation.

Short-term price consolidation near $249, combined with rising volumes on upward moves, signals growing momentum toward challenging the $250 resistance.

As tokenized yield markets expand, AAVE’s ability to integrate new financial products while maintaining strong support zones positions it for continued growth amid macroeconomic headwinds.

More Stories

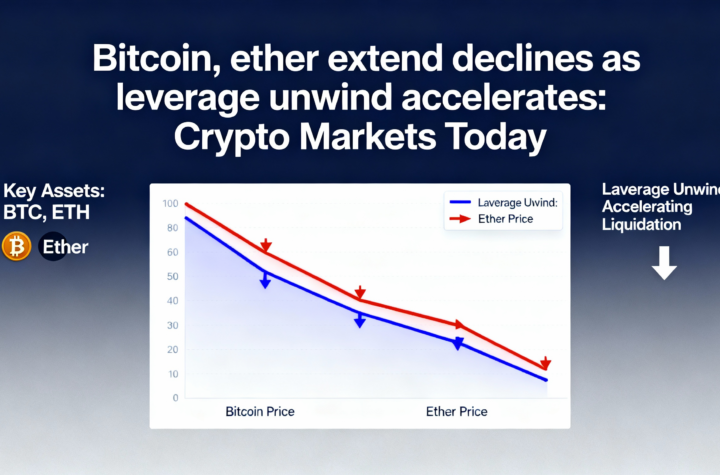

Anatomy of BTC’s selloff: the dollar’s bottom marked bitcoin’s top.

Silver plunges 35% and gold slides 12% amid a metals selloff, with bitcoin holding firm at $83,000.

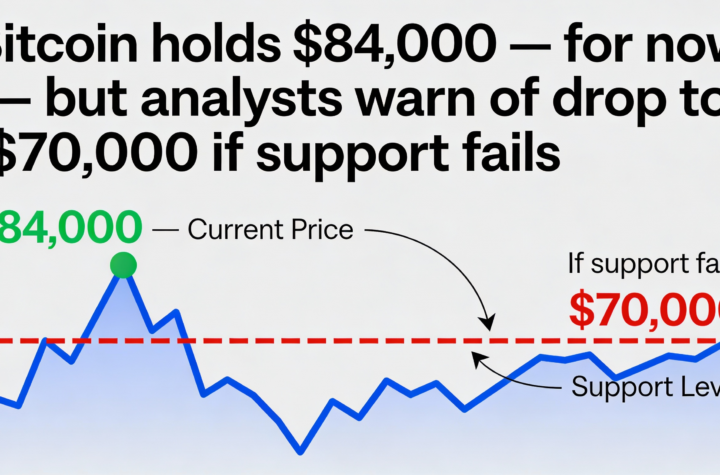

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.