XRP Trapped Below $3 as Institutional Activity Builds Ahead of ETF Launch

XRP is caught in a tight consolidation range just below the $3.00 mark, with institutions quietly accumulating as the ProShares XRP Futures ETF nears its debut.

Market Snapshot:

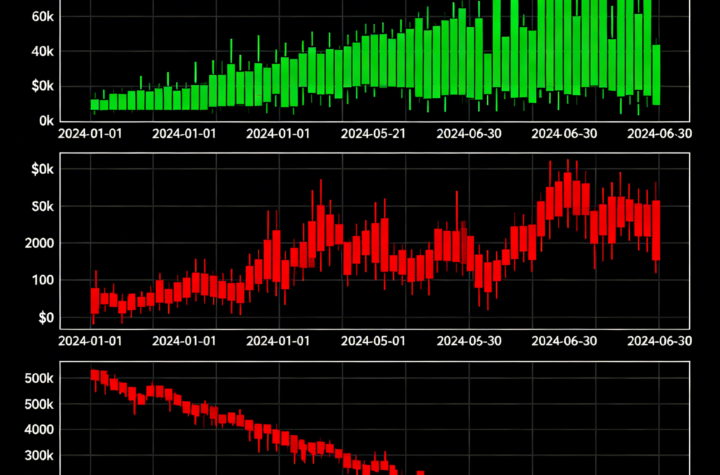

- XRP moved between $2.82 and $2.93 over the past 24 hours, a 4.08% trading range, ultimately closing at $2.89, up 1.8% on the day.

- Four breakout attempts above the $2.92–$2.93 zone were rejected at 12:00, 13:00, 17:00, and 18:00, signaling coordinated sell-side pressure from institutional desks.

- Treasury buyers stepped in around $2.85, with volumes exceeding the 78.9M daily average, particularly during accumulation surges at 14:00 and 19:00.

- A late-session recovery from $2.87 to $2.90 (+0.69%) was powered by large-volume bursts exceeding 2 million tokens — a strong sign of strategic buying.

Institutional Positioning Intensifies

With ProShares’ XRP Futures ETF set to launch July 18, professional investors are adjusting exposure ahead of anticipated volatility. Despite bullish momentum, the $3.00 psychological barrier remains unbroken, as desks continue to rebalance within a defined band. Ongoing regulatory uncertainty is preventing full allocation, keeping XRP stuck in a narrow trading corridor.

Price Action Summary:

- Range: $2.82 → $2.93

- Spread: $0.12 (4.08%)

- Rejections: Multiple failed attempts at $2.92–$2.93

- Support: $2.85 level supported by repeated treasury interest

- Late Action: XRP rose from $2.88 to $2.90 on heavy buying

- Volume Spike: Over 2 million tokens traded between 02:36–02:42

Technical Picture:

- XRP is consolidating below $3.00, with no breakout confirmation

- Strong support zone identified at $2.85–$2.88

- Resistance at $2.93 remains firm, acting as a sell-side trigger

- Higher lows forming, suggesting accumulation bias

- A confirmed breakout would need volume exceeding 100M alongside a clean move above $2.93

Key Questions for Traders:

- Will XRP crack $2.93 resistance before the ETF launch — or stay range-bound?

- Are current accumulation patterns setting up for a breakout post-July 18?

- Can a clean break above $3.00 trigger corporate portfolio upgrades?

- Failure to hold $2.88 could prompt a pullback toward $2.82

Final Takeaway:

XRP is in a holding pattern, with institutional players quietly building positions while respecting resistance levels. Support at $2.85 is active, but $2.93 remains the barrier to upside continuation. With the ETF launch just ahead, volume and timing will determine whether XRP finally breaks out — or slips back into range.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%