In December, mining profitability rose as bitcoin’s price surge outpaced the increase in the network’s hashrate, according to a new report by Jefferies. U.S.-listed bitcoin miners represented 25.3% of the total network hashrate during the month.

Jefferies also lowered its price target for MARA Holdings (MARA) to $20 from $24, while keeping a “hold” rating on the stock. The shares saw a modest gain of 0.5%, reaching $18.43 in early Friday trading.

The 15% increase in bitcoin’s price in December drove an improvement in mining profitability, while the network’s hashrate grew by 6.5%. Hashrate is a key metric for the mining sector, indicating the amount of computational power being deployed on the blockchain.

Jefferies noted that the average daily revenue per exahash increased by 7.1% to $59,585, compared to November.

U.S.-listed miners produced a total of 3,602 bitcoins in December, up from 3,404 in the previous month. MARA was the largest producer with 890 BTC mined, followed by CleanSpark (CLSK), which mined 668 BTC.

MARA maintained its leadership position with the largest installed hashrate in the sector at 53.2 exahashes per second (EH/s), while CleanSpark held the second spot with a hashrate of 39.1 EH/s.

More Stories

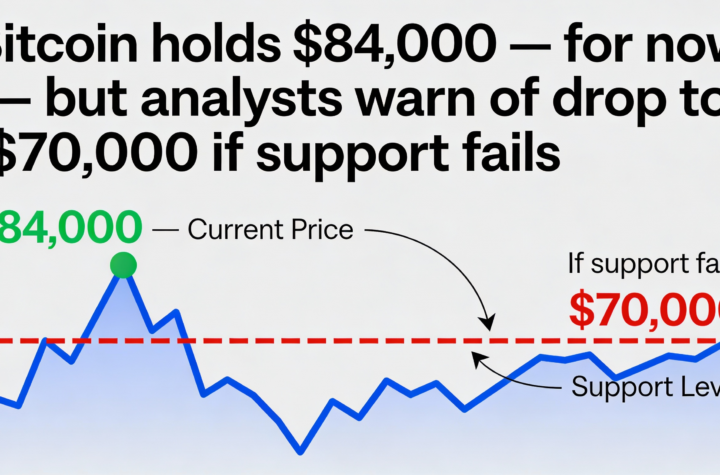

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

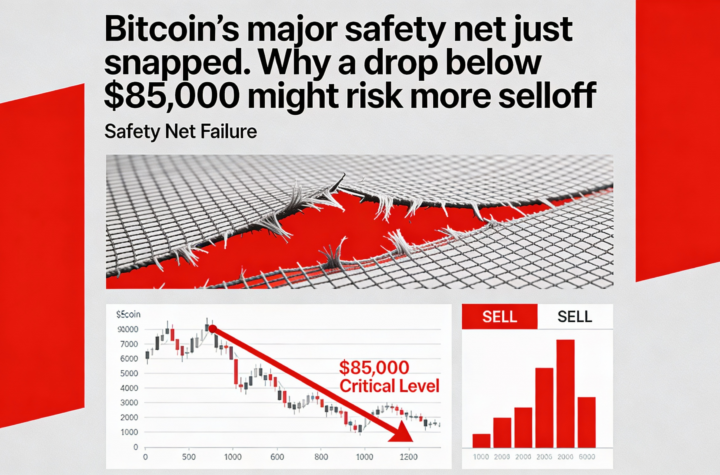

Crypto equities fall amid plunging spot volume and Bitcoin slipping under $84K

Dogecoin falls 7% as Bitcoin volatility spurs caution among memecoin traders.