Treasure Global Targets $100M Crypto Reserve to Support AI and Loyalty Innovation

Treasure Global (NASDAQ: TGL) has announced plans to allocate up to $100 million into digital assets, leveraging a mix of institutional backing and equity financing to build a diversified crypto treasury.

The Malaysia-based fintech company aims to invest in a basket of digital assets that includes bitcoin (BTC), ethereum (ETH), and regulated stablecoins, using proceeds from a capital facility and a new strategic partner.

According to the company, the crypto allocation will fuel the rollout of an upcoming AI-powered consumer insights platform, and lay the groundwork for future product integrations like blockchain-based loyalty rewards and digital asset payment tools.

Treasure Global follows a growing trend of public companies integrating crypto into their corporate strategies. Peers such as K Wave Media, Strategy, and Metaplanet have all disclosed digital asset reserve plans in recent weeks.

The news pushed TGL shares up over 11% on Wednesday, lifting the company’s market cap to approximately $4.34 million.

More Stories

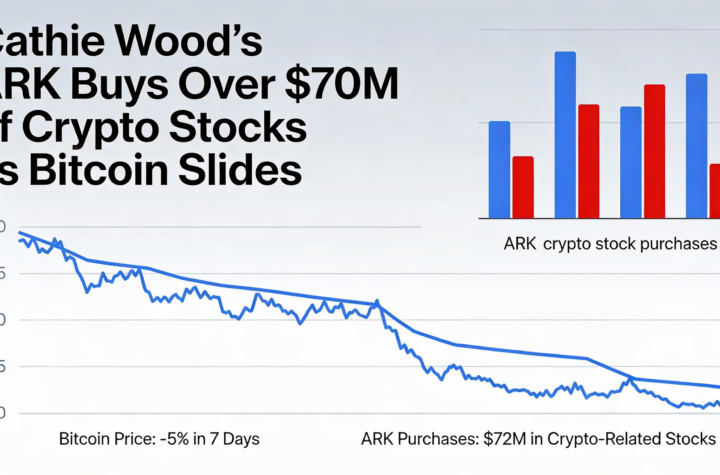

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO