Uniswap’s UNI token has faced notable intraday volatility amid growing global trade tensions, driving significant price swings and heightened trading volumes across key market levels.

The cryptocurrency market remains on edge as geopolitical uncertainties weigh on investor sentiment. UNI’s 10.9% price range over the past day highlights the token’s sensitivity to these external pressures, with traders balancing caution and opportunism.

Despite the swings, UNI managed to climb above critical resistance zones, indicating potential stabilization after a period of sharp corrections.

Technical Overview:

- UNI fluctuated between a high of 6.589 and a low of 5.945, a 10.9% range, as per CoinDesk Research’s data.

- A heavy selloff occurred between 16:00 and 01:00, with prices falling from 6.510 to 5.954 on high volume (4.4 million tokens), creating a firm support base.

- A partial recovery followed, with resistance forming near 6.120 and consolidation between 6.000 and 6.050, reflecting market hesitation.

- In the closing hour, UNI dipped to 6.017 but rebounded strongly, rising 3.6% to 6.054 on increased volume (28,700 tokens), signaling renewed buyer interest.

- The token formed a bullish channel between 6.030 support and 6.055 resistance, closing at 6.051, hinting at possible short-term price stability.

As trade tensions persist, UNI’s price dynamics underscore the ongoing influence of geopolitical events on crypto markets.

More Stories

XRP Posts an 89% Surge Over the Past Year While Bitcoin, Ether, and the CD20 Index Lag With Mild Performance

Singapore Exchange Unveils BTC and ETH Perpetual Futures Linked to iEdge CoinDesk Benchmarks

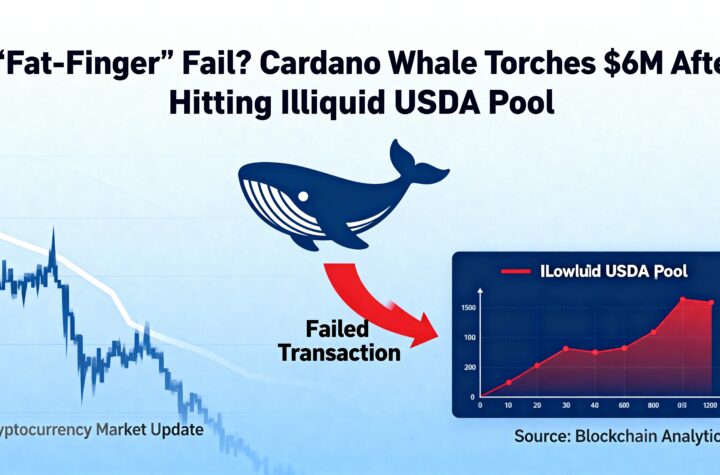

$6M Gone: Cardano Whale Hit by Illiquid USDA Pool in Suspected Fat-Finger Mishap