Bitcoin Miners Gain Favor at JPMorgan Amid Strong Q3 Performance and BTC Surge

JPMorgan (JPM) has adjusted its stance on several bitcoin (BTC) mining stocks, citing impressive third-quarter earnings, a surge in bitcoin’s price, and increasing network hashrates. The bank shared its updated views in a report released Tuesday.

Cipher Mining (CIFR) and CleanSpark (CLSK) were both upgraded to “overweight” from “neutral.” Cipher received a new price target of $8, while CleanSpark’s target saw a significant boost to $17 from $10.50. Marathon Digital Holdings (MARA) was upgraded to “neutral” from “underweight,” with its price target jumping to $23 from $12.

On the other hand, Iris Energy (IREN) was downgraded to “neutral” from “overweight,” though its price target was raised to $15 from $9.50. Riot Platforms (RIOT) maintained its “overweight” rating, with an increased price target of $16, up from $9.50.

JPMorgan also introduced a new valuation framework for miners, incorporating their operational capacities, infrastructure assets such as land and energy resources, and their bitcoin reserves. This comprehensive approach reflects the evolving dynamics of the sector.

Following the report, mining stocks reacted positively in early trading. Cipher Mining rose 4%, CleanSpark climbed 3.5%, MARA advanced 2%, Riot Platforms gained nearly 2%, and Iris Energy inched up 0.4%.

The bank’s upbeat revisions underscore the growing investor confidence in bitcoin miners, driven by the cryptocurrency’s recent rally and the industry’s strengthened financial metrics.

More Stories

According to Galaxy Digital’s research chief, Bitcoin faces a highly unpredictable 2026.

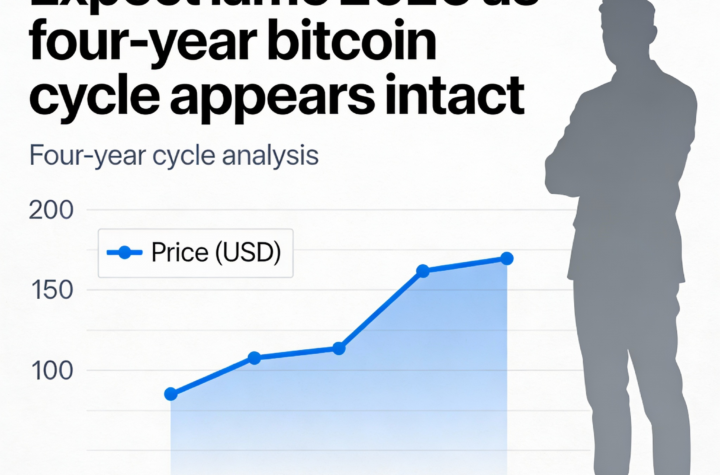

According to Fidelity’s Jurrien Timmer, 2026 could be underwhelming while Bitcoin’s four-year cycle remains intact.

BlackRock’s Bitcoin ETF attracts $25 billion over the year, defying the recent Bitcoin downturn.