India Introduces Stricter Crypto KYC Rules to Combat Money Laundering and Terror Financing

India’s Financial Intelligence Unit (FIU) has rolled out tougher identity verification requirements for cryptocurrency exchanges to prevent money laundering and terrorist financing, the Press Trust of India reported.

Under the new guidelines, effective Jan. 8, exchanges must verify users with a live selfie capturing blinking to confirm authenticity, while also logging their location, date, time, and IP address. Beyond the mandatory Permanent Account Number (PAN), exchanges must collect government-issued IDs such as passports, driver’s licenses, Aadhaar cards, or voter IDs, and verify mobile numbers and emails via one-time passwords (OTPs).

Bank account ownership is confirmed through the “penny-drop” method, involving a refundable charge of 1 rupee (INR). High-risk users—including those linked to tax havens, FATF-listed jurisdictions, politically exposed persons, or certain non-profit organizations—face enhanced due diligence every six months.

Exchanges are barred from supporting initial coin offerings (ICOs) or initial token offerings (ITOs) and from using tools like tumblers that obscure transactions. All platforms must register with the FIU, report suspicious trades, and retain user data for five years. The FIU cited ICOs and ITOs as high-risk with limited economic justification.

India continues to classify cryptocurrencies as virtual digital assets (VDAs) under the Income Tax Act, 1961. Citizens may buy and sell VDAs on FIU-registered platforms, but cannot use them as legal tender for goods or services.

More Stories

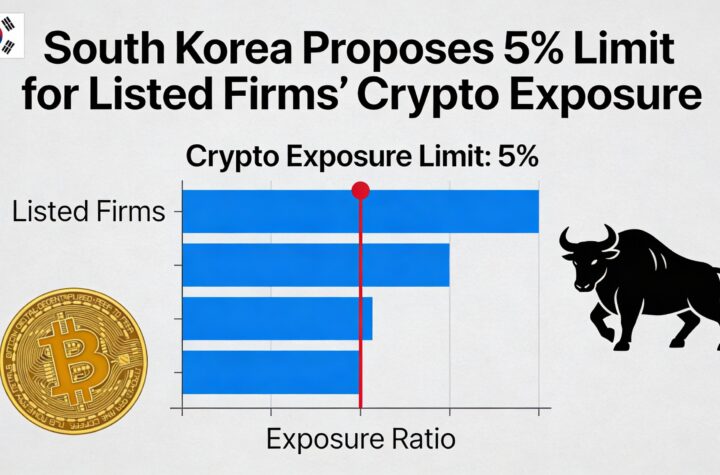

South Korea proposes a 5% limit on crypto holdings for publicly traded firms.

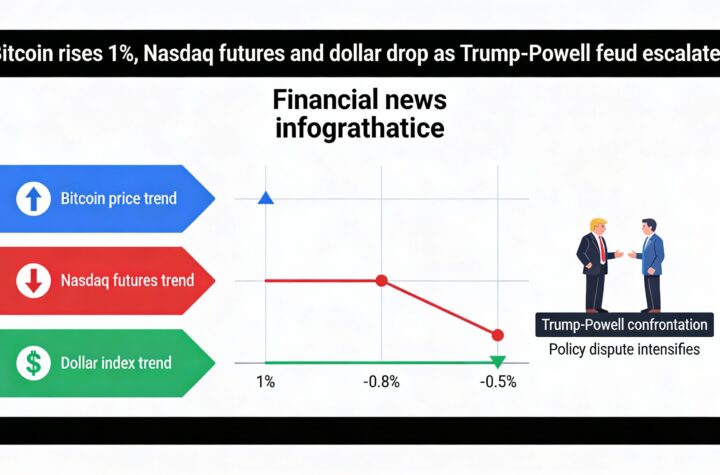

Amid escalating Trump-Powell feud, bitcoin climbs 1% while Nasdaq futures and dollar retreat.

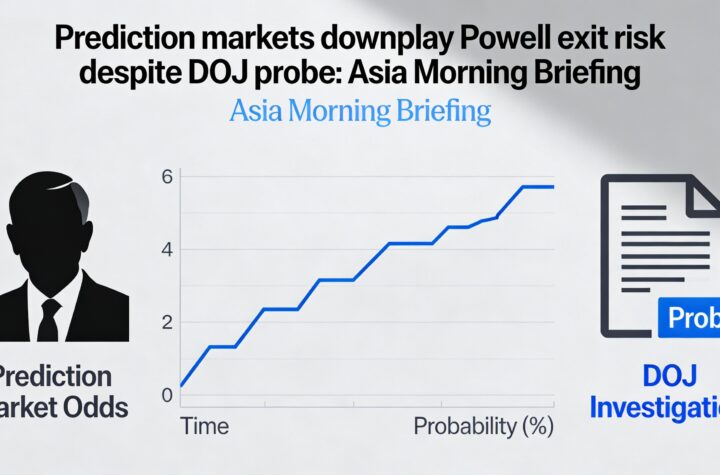

Despite the DOJ probe, markets are discounting the risk of Powell stepping down: Asia Morning Briefing.