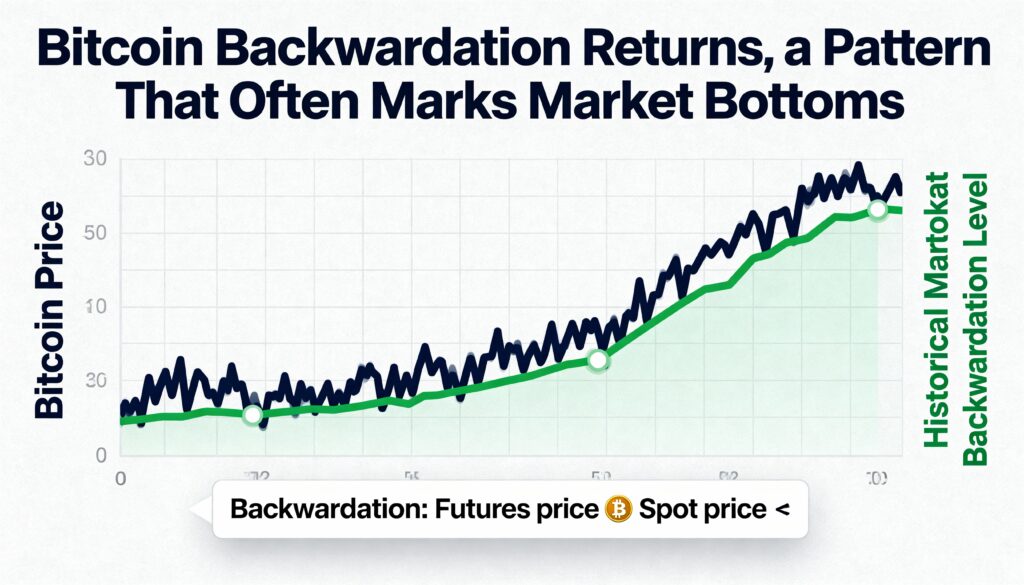

Bitcoin Futures Slip Into Backwardation, Flashing a Classic Fear Signal That Often Precedes Market Bottoms

Bitcoin has entered backwardation — a condition where futures contracts trade below the spot price — reflecting heightened fear, forced hedging, and widespread de-risking across the market. The shift comes as BTC extends a nearly 30% retreat from its all-time high.

Thomas Young, Managing Partner at RUMJog Enterprises, highlighted the rarity of this setup in a post on X, noting that it frequently appears during moments of extreme stress. “Backwardation doesn’t happen often, and when it does, it usually reflects forced de-leveraging or a short-term capitulation zone,” he wrote. Historically, this structure often precedes market reversals or marks the final flush before a bottom forms.

Backwardation has reliably aligned with major BTC lows:

• November 2022: marked the cycle bottom around $15,000 during the FTX meltdown.

• March 2023: appeared as BTC briefly dipped under $20,000 amid the SVB crisis and USDC depeg.

• August 2023: resurfaced during the Grayscale ETF-driven sell-off near $25,000, just before a sharp rebound.

Currently, bitcoin’s three-month annualized futures basis has collapsed to roughly 4%, its lowest reading since November 2022. The basis reflects the return from buying spot BTC and selling a three-month futures contract — a spread that is normally positive. In bullish periods, traders aggressively bid futures for leveraged upside exposure, pushing the basis higher. It reached 27% in March 2024 as BTC surged to $73,000.

The compression of that premium now illustrates a drastic reduction in leveraged long appetite, pointing to a more defensive market posture. While bitcoin typically trades in mild contango, extreme optimism can drive the curve sharply higher; in fearful markets, it frequently flips into backwardation.

The current structure underscores a market still absorbing recent losses — but also one that, historically, has been near major turning points

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin