Bitcoin’s downturn deepened on Thursday as the cryptocurrency slid below the $100,000 threshold, extending its decline to a low of $96,600 during early Asian trading. The move marks bitcoin’s weakest level since May and comes amid a broader risk-off shift across global markets, driven by a sharp pullback in U.S. tech stocks and diminishing institutional confidence.

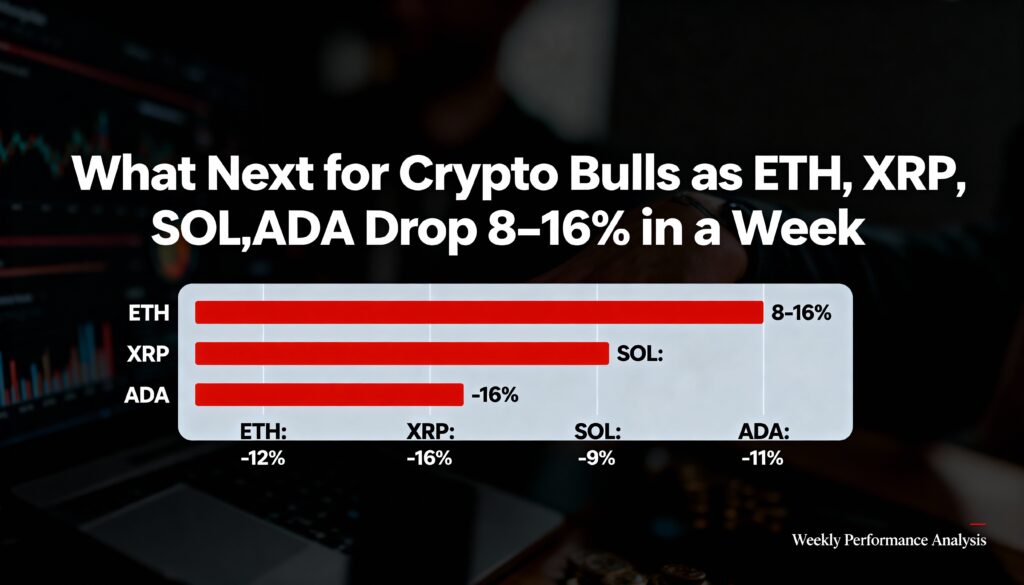

Major altcoins dropped alongside BTC. Ether fell 0.8% on the day to $3,182, down 12% over the week. XRP traded at $2.25 following an 8.8% weekly slide, while BNB retreated to $932, losing nearly 8% during the same stretch.

Structural cracks in the market continue to widen. ETF inflows have weakened for a second straight week, long-term holders are distributing coins at an increasing pace, and retail participation remains subdued. Research firm 10x said these overlapping trends confirm the market has shifted into a bearish phase, with the usual pillars of support — institutional flows, corporate allocation and ETF issuance — no longer providing meaningful reinforcement.

Technically, bitcoin’s breakdown below the monthly mid-range at $100,266 has cleared a significant liquidity shelf, leaving price action exposed to a rapid move through thinner market regions. Analysts now view the $93,000–$95,000 range as the next key support. A decisive break below that zone could open the way for a deeper drop toward the $89,600 liquidity gap, according to derivatives firm Bitunix.

On the upside, any rebound is likely to encounter resistance at $100,200, followed by a heavier ceiling at $107,300 — a level repeatedly rejected in recent weeks. Liquidity conditions remain fragile with no confirmed signs of stabilization.

Bitunix noted that a temporary base may emerge near $93,000, though a failed defense could accelerate BTC’s descent into lower structural pockets. Nick Ruck of LVRG Research added that bitcoin’s ability to steady around $92,000 may depend on whether upcoming FOMC minutes lean dovish. Persistent ETF outflows, a developing death-cross signal, and uncertainty surrounding post-shutdown economic data continue to weigh on momentum.

Bitcoin has now erased the full 30% advance it captured earlier this year. The current unwind stretches back to the October 6 peak at $126,251, a record fueled by optimism around the Trump administration’s pro-crypto stance. That enthusiasm evaporated quickly after unexpected tariff comments from the president sparked global volatility and triggered widespread deleveraging across risk assets.

Bitcoin briefly slipped below $93,700 on Sunday before rebounding to around $94,800 early Monday.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin