XRP Extends Gains Above $3 as ETF Speculation and SBI Lending Boost Demand

Seven XRP ETF applications remain under SEC review, with the first rulings expected on October 18.

XRP continued to climb above the key $3.00 level on Thursday, supported by renewed institutional demand and optimism surrounding pending U.S. ETF decisions. Japan’s SBI Holdings’ expansion of institutional XRP lending added to bullish momentum, while traders identified a firm short-term base forming near $2.99. Heavy resistance remains around $3.10 after elevated trading activity.

Market Drivers

The token rose roughly 3% between October 2 (04:00 UTC) and October 3 (03:00 UTC), advancing from $2.98 to $3.03. The move came as SBI Holdings broadened its XRP lending products, signaling deepening institutional engagement from Japan.

Meanwhile, Ripple CTO David Schwartz confirmed his departure after 13 years, marking a leadership shift amid a pivotal regulatory window. The SEC currently has seven XRP ETF filings under review, with the first decisions anticipated by October 18.

Prediction markets now price approval odds at over 99%, fueling speculative inflows and positioning XRP as one of the most-watched altcoins heading into mid-October.

Price and Volume Trends

- Range: XRP traded within a $0.15 corridor ($2.95–$3.10), representing a 4.9% daily range.

- Volume Spike: At 16:00 UTC, XRP surged from $3.00 to $3.06 on 212.6 million tokens traded, more than double its average daily turnover.

- Resistance Zone: The rally stalled at $3.10, where over $129 million in transactions capped upside momentum.

- Consolidation: Price held steady in the $3.00–$3.05 band, indicating sustained institutional accumulation.

- Rebalancing: In late-hour trading, XRP dipped slightly to $3.02, accompanied by a 2.35 million token spike suggesting portfolio adjustments by large holders.

Technical Overview

Support has been reaffirmed near $2.99–$3.00, an area repeatedly defended by buyers. Resistance remains defined around $3.10, coinciding with heavy institutional sell orders.

The current consolidation above $3.00 reflects accumulation dynamics consistent with prior pre-breakout setups. A confirmed daily close above $3.10 could trigger a measured move toward $3.20, aligning with the next technical target.

Key Catalysts Ahead

- Whether XRP maintains closes above $3.00 and challenges the $3.10 ceiling.

- Institutional repositioning ahead of the October 18 ETF review window.

- SBI’s lending activity and its impact on Asian liquidity flows.

- Broader CD20 index confirmation as altcoin rotations mirror XRP’s performance.

More Stories

SharpLink, an Ethereum treasury firm, locks $170M in ETH on Linea.

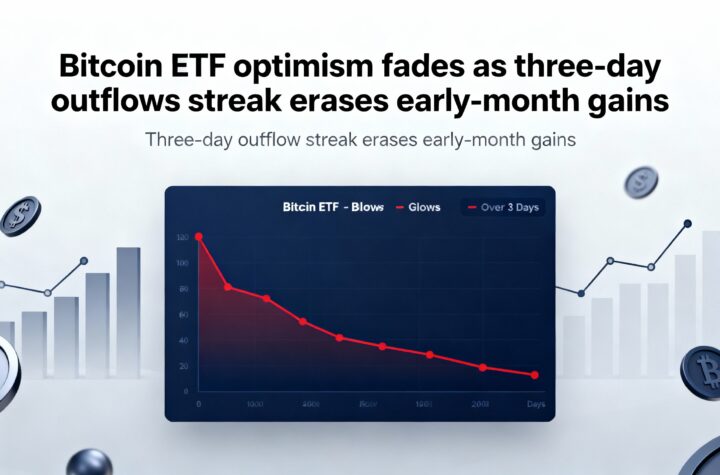

Early-month gains evaporate as Bitcoin ETFs see a three-day streak of outflows.

The team behind Zcash wallet Zashi announces plans for a new venture, ‘cashZ’.