Grayscale Moves to Launch First U.S. Chainlink ETF

Grayscale has submitted a filing to the U.S. Securities and Exchange Commission (SEC) to convert its Chainlink Trust into a spot exchange-traded fund (ETF), potentially trading on NYSE Arca under the ticker GLNK. The S-1 registration is a formal step toward ETF approval.

If authorized, the ETF could include a staking feature, enabling the fund to earn rewards via third-party providers while holding LINK tokens in custodian wallets. Depending on regulatory guidance, staking rewards may be retained by the fund, distributed to shareholders, or sold to cover expenses.

The proposed ETF would replace the Grayscale Chainlink Trust, which manages nearly $29 million in assets since February 2026. Coinbase Custody Trust Company will remain as custodian. Shares would primarily be created and redeemed in cash, in line with recently approved spot Bitcoin and Ethereum ETFs, though in-kind redemptions may be permitted under future regulations.

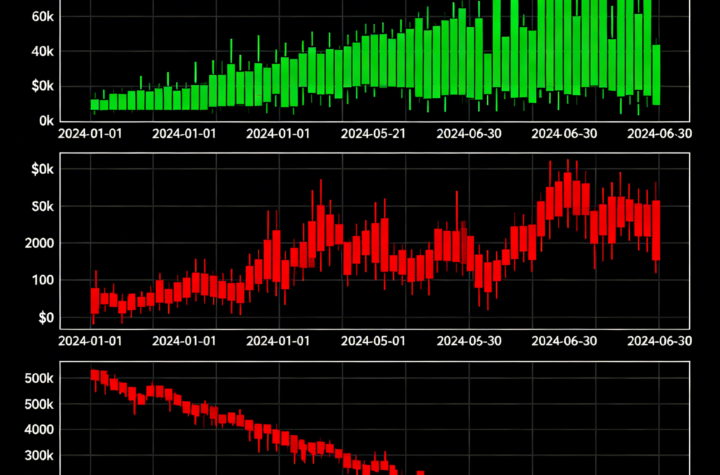

LINK has risen 3% over the past 24 hours, joining a broader altcoin rally that includes XRP (+2.6%), Solana (+5%), and Dogecoin (+7.4%).

Grayscale’s filing is part of a broader strategy to convert its single-asset crypto trusts into ETFs, with other proposals tied to SOL, DOGE, and XRP. The SEC, led by Chair Paul Atkins, has yet to approve these applications, but Grayscale is positioning itself to launch some of the first crypto ETFs in the U.S.

A successful GLNK ETF would give traditional investors regulated exposure to Chainlink, the decentralized oracle network that powers smart contracts, while staking could provide an income component not widely available in existing U.S. crypto ETFs.

Market sentiment appears optimistic, with LINK posting some of the strongest gains among major cryptocurrencies on the day.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%