CME Group Expands Bitcoin Derivatives With Options on Friday Futures

CME Group is set to launch options on its Bitcoin Friday Futures (BFF) starting Feb. 24, pending regulatory approval. The new contracts will provide daily expiration from Monday to Friday, offering traders increased flexibility in managing bitcoin price risk.

Since BFF’s debut on Sept. 29, it has become CME Group’s most successful crypto product, with over 775,000 contracts traded. The futures see an average daily volume of 9,700 contracts, with nearly 44% of trading occurring outside U.S. hours. Each contract represents one-50th of a bitcoin, contributing to a cumulative trading volume of $1.63 billion.

Giovanni Vicioso, CME Group’s Global Head of Cryptocurrency Products, emphasized the benefits of the new options:

“These contracts will allow market participants to fine-tune their bitcoin exposure with smaller contract sizes and daily expirations. The success of Bitcoin Friday Futures highlights strong demand for regulated crypto derivatives, and we’re excited to build on that momentum.”

The move signals growing institutional interest in bitcoin derivatives and aims to enhance risk management strategies for both retail and institutional traders.

More Stories

Silver plunges 35% and gold slides 12% amid a metals selloff, with bitcoin holding firm at $83,000.

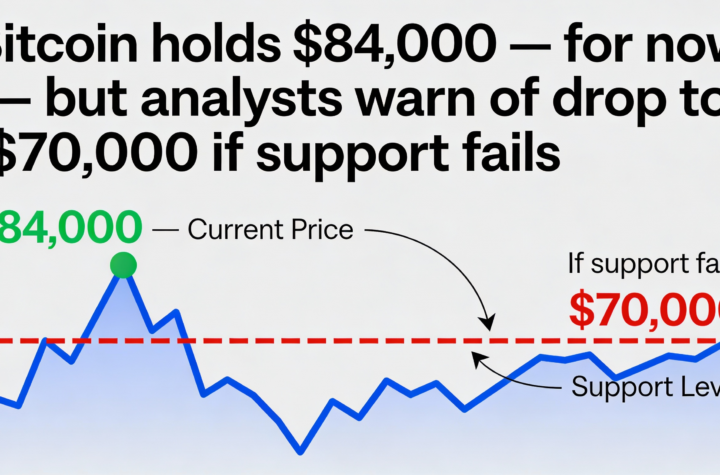

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

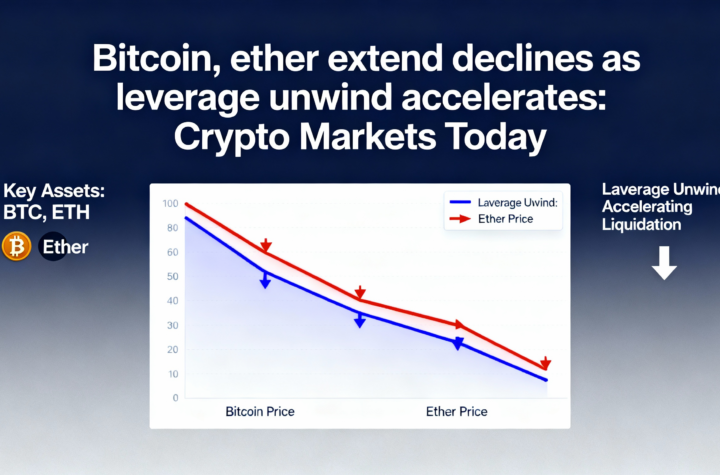

Crypto selloff intensifies as bitcoin and ether extend losses amid leverage unwind