XRP Nears $3 as Volume Spikes and Institutions Return to the Market

XRP moved closer to the key $3 level in its latest trading session, supported by a sharp rise in volume and renewed institutional participation. On-chain metrics revealed nearly 155 million XRP in turnover during the recovery rally — well above the 63 million daily average — signaling increased demand from large players.

Market Overview

- XRP’s rebound is unfolding alongside a broader recovery in digital assets, as altcoins attract modest capital inflows following last week’s selloff.

- Large-scale wallet activity highlighted by on-chain data suggests institutional re-engagement, helping XRP outperform peers in the short term.

- While some early reports hinted at new record highs, XRP remains below its January 2018 all-time high of $3.84 — positioning this move as a recovery phase rather than a breakout to uncharted territory.

Price Movement

- XRP fluctuated within a 5.1% range between $2.84 and $2.99 over the 23-hour span from Aug. 20 at 13:00 UTC to Aug. 21 at 12:00 UTC.

- The most significant upward move occurred at 19:00 UTC on Aug. 20, when XRP surged from $2.84 to $2.99 on trading volume exceeding 80.6 million.

- Prices later stabilized, with repeated tests of the $2.89–$2.93 area confirming it as interim support.

- A final-hour swing on Aug. 21 (11:03–12:02 UTC) saw an 8.6% drop from $2.916 to $2.901 on 960,000 units before steadying.

Technical Picture

- Support Zone: $2.89–$2.93 is showing strength, with multiple high-volume bounces reinforcing it as a key short-term floor.

- Resistance Level: $2.99–$3.00 remains a major barrier, with consistent rejections preventing a clean breakout.

- Volume Profile: Trading activity spiked to 80.65 million XRP — well above the 24-hour norm of 63 million.

- Market Structure: XRP is currently consolidating after a bullish push, with signs of waning momentum unless volume remains elevated.

What Traders Are Watching

- The ability of $2.93 to hold as support — a breakdown could trigger a retreat toward $2.82.

- A sustained move above $3.00 would likely attract further buying and signal trend continuation.

- Market participants are closely monitoring volume trends; weakening flows may erode bullish control and invite selling pressure.

More Stories

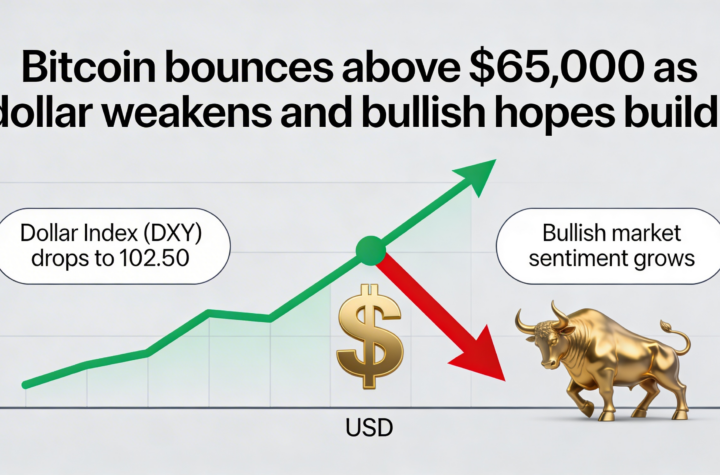

A firmer bounce lifts Bitcoin above $68,500, with Circle driving upside momentum across crypto stocks

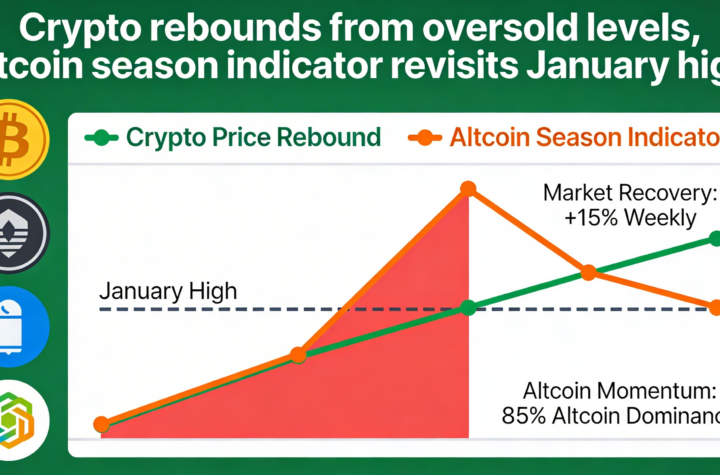

Crypto stages a rebound from technical lows while the altcoin season indicator revisits levels last seen in January.

The U.S.-chartered crypto firm has taken a position in preferred stock from bitcoin treasury company Strategy.