Chainlink’s LINK Leads Market Gains with 42% Weekly Surge on ICE Partnership, Token Buybacks

Chainlink’s LINK token soared 10% on Tuesday, reaching a seven-month high above $24, driven by a major partnership announcement and rising investor demand through a new buyback program.

LINK has now climbed 42% over the past week—the strongest performance among the top 50 cryptocurrencies by market capitalization, according to CoinDesk data.

The rally follows news of a collaboration between Chainlink and Intercontinental Exchange (ICE), parent company of the New York Stock Exchange. The partnership will deliver real-time foreign exchange and precious metals pricing on-chain, strengthening Chainlink’s position as a core infrastructure provider for bridging traditional finance with blockchain networks.

Additional buying pressure is coming from the Chainlink Reserve initiative, unveiled last week, which plans to convert protocol and enterprise revenue into LINK tokens. The mechanism is designed to introduce persistent demand for the asset.

Technical Setup Points to More Upside

LINK is currently trading above both its 50-day and 200-day moving averages—a bullish signal. Immediate resistance lies near $24.10–$24.13, with short-term support between $21.00 and $21.30.

With the Relative Strength Index (RSI) nearing overbought territory at 72.72, some consolidation may be likely. However, a strong move above current resistance could spark the next leg of the rally as momentum and institutional attention continue to build.

More Stories

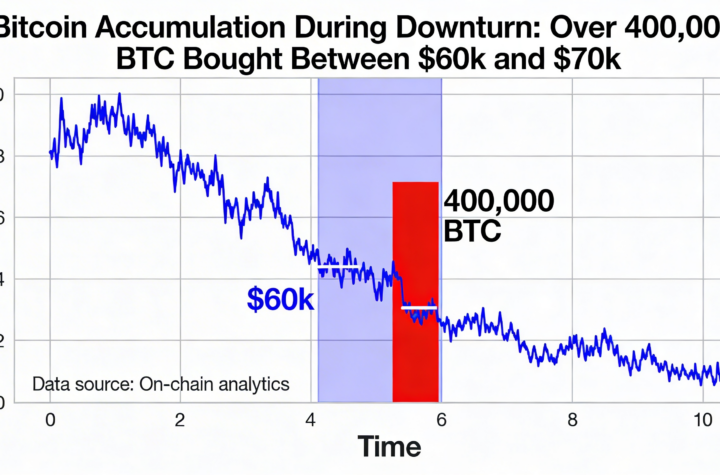

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

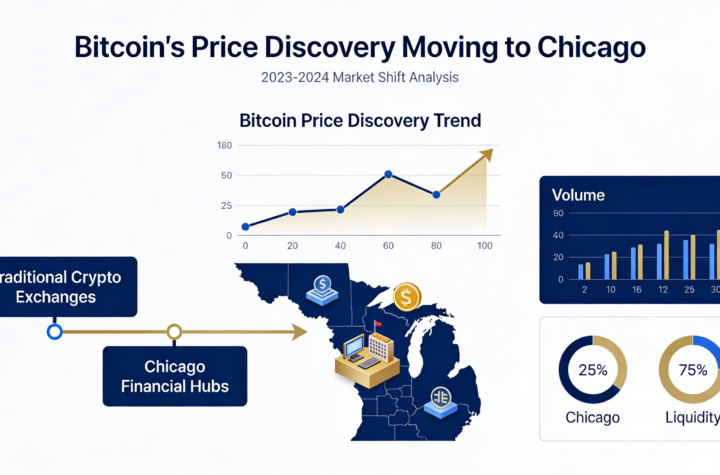

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago