DOGE Slides After Qubic Threat Sparks Security Fears and Derivatives Unwind

Dogecoin faced renewed selling pressure on Tuesday as security concerns collided with broader market weakness. A controversial governance vote by the Qubic blockchain community to potentially target Dogecoin with a 51% attack rattled sentiment, compounding losses despite continued whale accumulation.

The decline followed Qubic’s earlier claim of successfully compromising the Monero network, heightening concerns that a similar disruption could hit DOGE. Traders responded swiftly, pricing in increased risk, while leveraged positions across derivatives markets began to unwind.

Key Developments:

- Qubic’s forum approved a proposal to redirect hashpower toward Dogecoin, raising the prospect of a coordinated 51% attack.

- The move comes just days after Qubic claimed responsibility for disrupting Monero’s block validation process.

- Despite mounting fears, large wallets accumulated 680 million DOGE in August, suggesting long-term confidence.

- DOGE futures open interest dropped 8%, reflecting a pullback in leveraged bullish bets.

Price Action Overview:

- DOGE fell 5% over a 24-hour window from $0.22 to $0.21 between August 19 at 06:00 UTC and August 20 at 05:00 UTC.

- The steepest drop occurred between 13:00 and 15:00 UTC on August 19, when volume surged to 916 million — nearly double the daily average.

- $0.22 was firmly rejected as resistance, while $0.21 acted as short-term support.

- Late trading saw tight consolidation between $0.2120 and $0.2130, with the session ending at $0.2124.

Technical Breakdown:

- Resistance: Repeated rejection at $0.22 confirms a strong supply zone.

- Support: $0.21 is holding for now, though a break lower could test $0.208.

- Volume: Panic-driven selling pushed volume 100% above average.

- Price Structure: Narrow range in the final hours points to indecision, not recovery.

- Derivatives: 8% drop in futures open interest signals waning confidence among speculators.

Market Focus Ahead:

- Whether Qubic will follow through with the proposed DOGE network attack.

- How whale accumulation holds up against retail capitulation at current levels.

- Potential for further declines in open interest to impact volatility and trend direction.

- A confirmed move above $0.22 or below $0.21 as the next key breakout signal.

More Stories

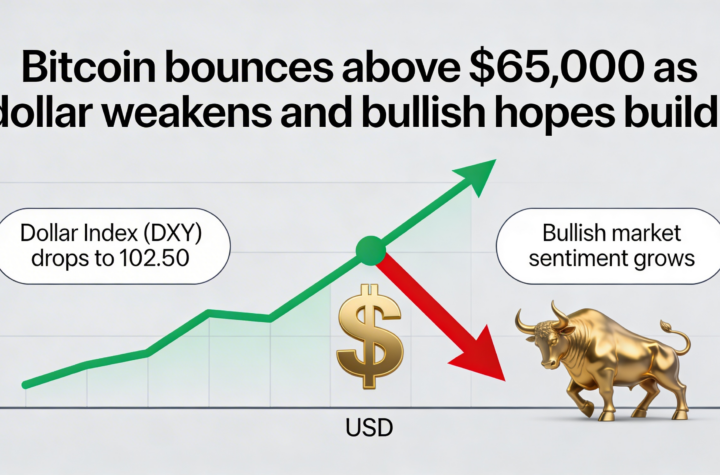

A firmer bounce lifts Bitcoin above $68,500, with Circle driving upside momentum across crypto stocks

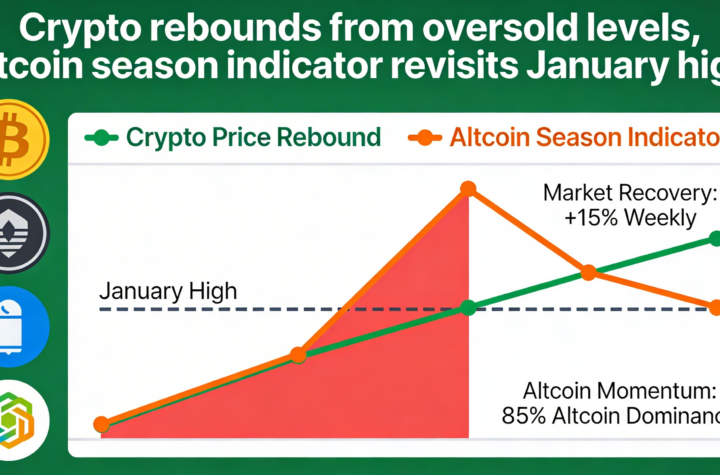

Crypto stages a rebound from technical lows while the altcoin season indicator revisits levels last seen in January.

The U.S.-chartered crypto firm has taken a position in preferred stock from bitcoin treasury company Strategy.