Bitcoin Drops to $113K as Analysts Weigh Market Fragility Against Long-Term Institutional Tailwinds

Bitcoin extended its decline into Tuesday’s Asia session, falling 3% to $113,000, while Ether slumped 5.6% to $4,100. The losses cap a week of weakness across crypto majors and highlight a growing disconnect between short-term price action and longer-term structural developments in the industry.

Despite a steady stream of bullish headlines, price momentum remains soft — a divergence that’s fueling debate among analysts over whether current conditions reflect genuine fragility or simply a pause before a more durable institutional phase.

Glassnode Warns of Shaky Market Structure

On-chain analytics firm Glassnode attributes the latest slide to a combination of stretched leverage, profit-taking pressure, and fading spot demand. In its latest report, the firm noted that despite nearly $900 million in inflows into U.S.-listed spot BTC ETFs last week, positioning remains vulnerable without sustained conviction in underlying markets.

“Momentum is thinning, and without fresh spot demand, markets are open to further deleveraging,” Glassnode wrote, painting a cautious near-term outlook.

Enflux Sees Institutional Shift Underway

Singapore-based market maker Enflux offered a contrasting view in a note shared with CoinDesk. The firm argued that the market is maturing faster than price charts suggest, pointing to recent structural shifts in capital and talent flows:

- Google emerging as the largest shareholder in bitcoin miner TeraWulf

- Wyoming rolling out a state-backed stablecoin

- Tether appointing a former White House crypto policy advisor

Enflux described the weak price action as a temporary disconnect, not a signal of broader deterioration. “These developments are building the foundation for an institutional-grade, regulatory-aligned market cycle,” the firm wrote.

Sentiment Split as Fundamentals Strengthen

The opposing views from Glassnode and Enflux underscore a broader tension across digital asset markets: while technicals and price action flash short-term weakness, fundamentals continue to improve beneath the surface.

Some see a fragile, leverage-heavy structure vulnerable to deeper unwinding. Others see that very pullback as noise — a backdrop to structural upgrades that could define the next phase of crypto’s evolution.

Market Snapshot

- BTC: Down 3.2% to $113,000 as traders de-risk ahead of Wednesday’s FOMC minutes and Powell’s Jackson Hole address Friday.

- ETH: Fell 3.5% to below $4,200 amid growing doubts about a September rate cut. Bank of America analysts warn Powell may lean hawkish given sticky inflation and tariff-driven cost pressures.

- Gold & Silver: Edged higher to $3,384.70 and $38.115 respectively as investors await clarity on U.S. policy direction.

- Nikkei 225: Dropped 1.14% to 43,050.89, reversing from recent highs amid renewed U.S. trade uncertainty.

- U.S. Futures: Largely flat in overnight trading. S&P 500 futures were steady, Dow unchanged, and Nasdaq 100 futures dipped 0.2% ahead of key retail earnings and Fed commentary.

More Stories

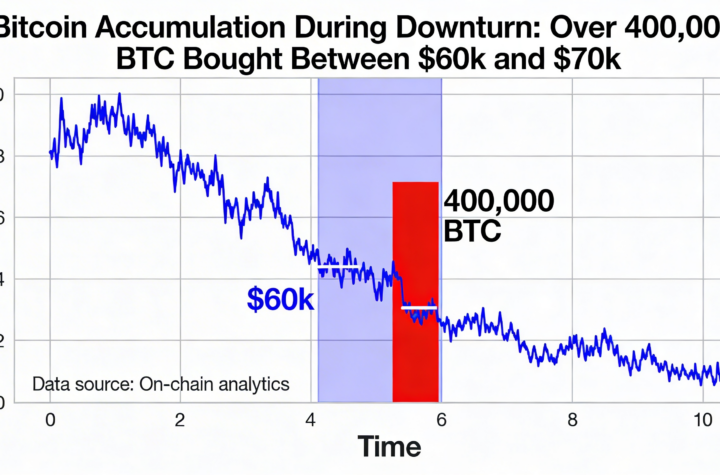

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

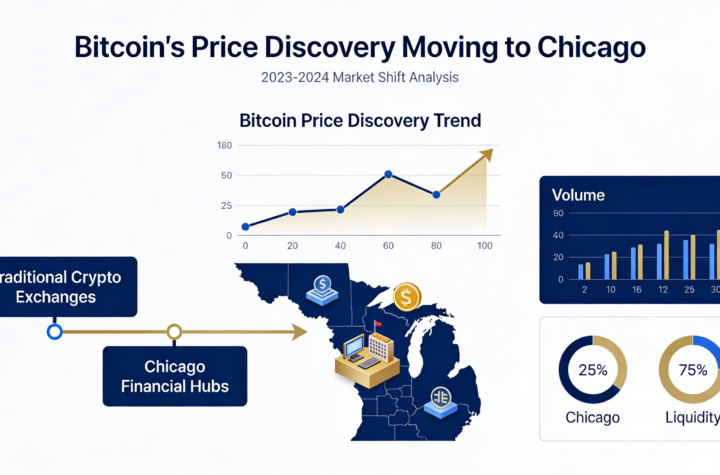

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago