Crypto Equities Sink as Bitcoin Slides to $113K; Traders Brace for Powell Speech

Bitcoin dropped to $113,000 on Tuesday, triggering a sharp selloff across crypto-related equities as investor risk appetite weakened ahead of Federal Reserve Chair Jerome Powell’s upcoming remarks at Jackson Hole.

MicroStrategy (MSTR), the largest corporate holder of BTC, fell 7.8% to $336 — its lowest closing price since April 22.

Companies with sizable Ethereum treasuries weren’t spared. SharpLink Gaming (SBET) and BitMine (BMNR) slid 8–9%, while Solana-exposed firms DeFi Development (DFDV) and Upexi (UPXI) plunged 13.7% and 9%, respectively.

Digital asset heavyweight Galaxy Digital (GLXY) sank 10%, leading declines among crypto investment names. Trading platforms also came under pressure, with Robinhood (HOOD) down 6.5% and Coinbase (COIN) off 5.8%.

Mining and infrastructure stocks saw steep losses as well. MARA Holdings (MARA) dropped nearly 6%, while high-performance computing players Bitdeer (BTDR), Iris Energy (IREN), and Hut 8 (HUT) each lost close to 10%.

The broad-based downturn reflects growing caution in the market as traders await potential policy signals from Powell’s speech at the Fed’s annual Jackson Hole symposium on Friday.

More Stories

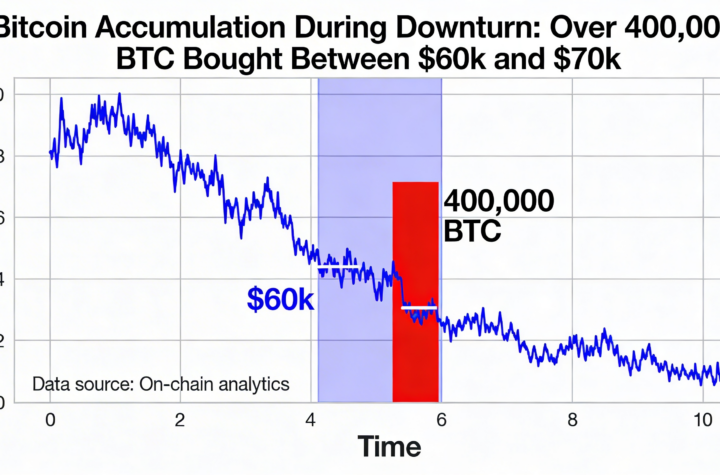

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

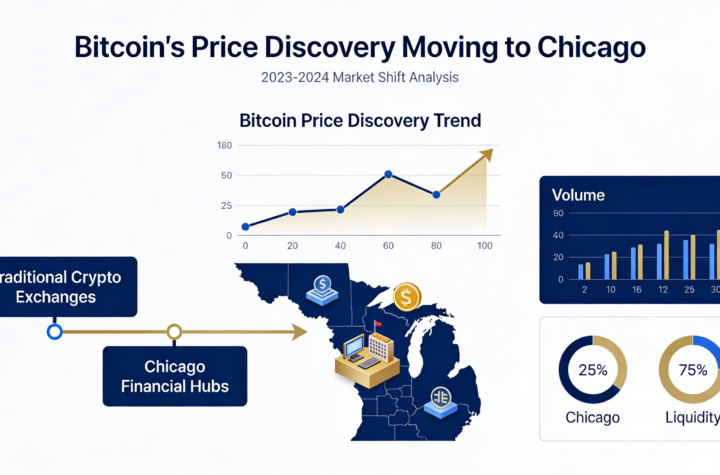

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago