Ether Rally Puts 97% of Holders in Profit, Stirring Potential Sell-Side Pressure

Ethereum’s (ETH) sharp price rally has pushed the vast majority of wallet addresses into profit, a milestone that, while bullish on the surface, could introduce renewed selling pressure in the short term.

Data from blockchain analytics firm Sentora shows that 97% of Ether addresses are now “in-the-money”, meaning their average purchase price is lower than ETH’s current market rate of $4,225. While this high profitability metric reflects market strength, it often precedes increased profit-taking as investors look to secure gains.

Supporting that view, Glassnode data reveals profit-taking activity is already intensifying. ETH’s profit realization—tracked via a seven-day simple moving average—has surged to $553 million per day, not far off the July peak of $771 million. This trend indicates that the market may be entering a phase of distribution.

A closer breakdown highlights a shift in who’s selling. During Ethereum’s last major top in December 2024, long-term holders (those holding ETH for over 155 days) led the wave of selling. This time, however, it’s short-term holders driving much of the realized profits, suggesting newer entrants are choosing to exit amid favorable price levels.

While Ethereum’s long-term trajectory remains constructive, historically elevated profit levels and shifting investor behavior may signal a pause—or even a temporary pullback—as the market digests recent gains.

More Stories

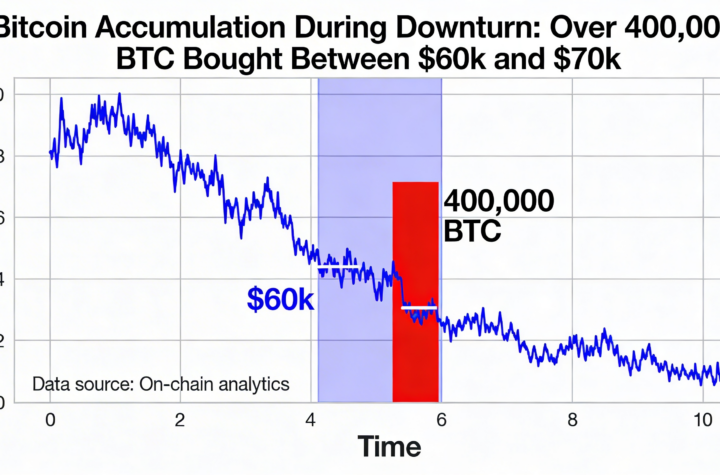

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

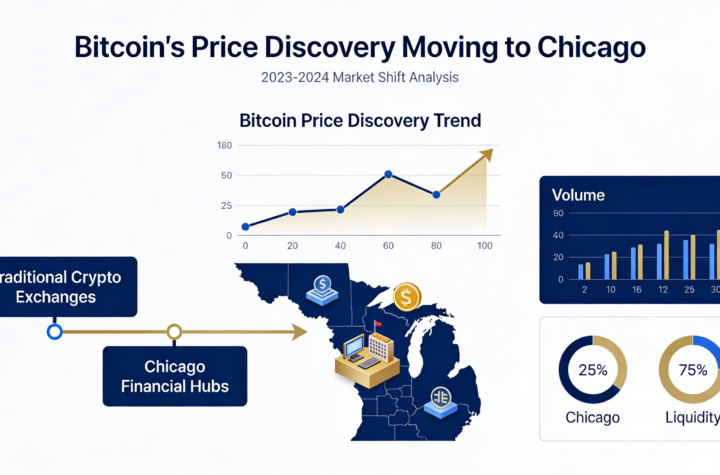

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago