SHIB Slides 6% as Whale Activity Rises, But Reversal Pattern Signals Possible Bounce

Shiba Inu (SHIB) declined sharply on Friday, falling 6% in 24 hours amid broader market weakness driven by renewed U.S. tariffs and a strengthening dollar. The token dropped from $0.000013 to $0.000012, its lowest level since July 9, extending its correction from July’s local peak of $0.000016.

The sell-off coincided with a notable rise in exchange balances. On July 28, centralized exchanges held 84.9 trillion SHIB tokens—suggesting distribution by larger holders—even as net accumulation totaled 4.66 trillion tokens worth $63.7 million, according to CoinDesk’s market insights model.

Adding to the volatility, the SHIB burn rate surged by 16,700%, with 602 million tokens destroyed in coordinated burn transactions, pointing to continued supply reduction efforts by the community.

Key Technical Developments:

- Resistance rejection at $0.000013 triggered high-volume selling pressure.

- Support was established near $0.000012, where over 1.19 trillion tokens changed hands.

- A late-session recovery saw SHIB rebound to $0.00001235 amid rising buyer interest and 90.5 billion tokens in breakout volume.

Technical Outlook:

Despite recent losses, July’s monthly candle closed with an “inverted hammer” formation—a classic potential reversal signal. This candlestick pattern, characterized by a small body and a long upper wick, suggests bullish resilience after a downtrend and may indicate a shift in momentum.

A break below the July low of $0.00001108 would invalidate the bullish reversal setup, while a move above $0.000013 could confirm renewed upward momentum.

More Stories

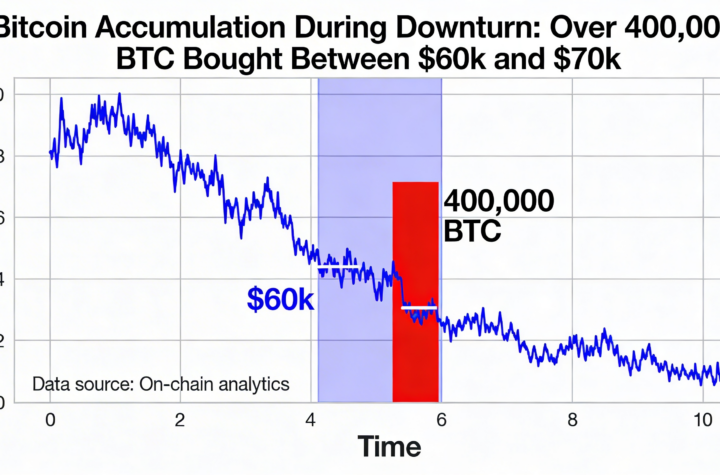

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

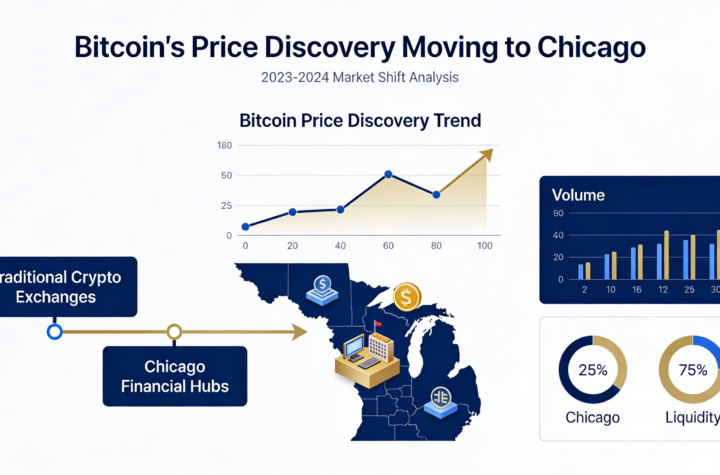

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago