Ethena’s USDe Surges Past $8.4B, Outpaces BlackRock’s Bitcoin and Ether ETFs in Inflows

Ethena’s synthetic stablecoin USDe is seeing explosive momentum, adding over $3.14 billion in supply in just 20 days — a pace that surpasses combined inflows into BlackRock’s IBIT and ETHA ETFs over the same period.

Since July 17, USDe’s circulating supply has grown to $8.4 billion, making it the fastest growth spurt since Ethena launched in February 2024, based on on-chain data compiled by the project’s community. In contrast, BlackRock’s ether ETF (ETHA) attracted $2.75 billion and its bitcoin ETF (IBIT) brought in $1.6 billion during the same window, putting USDe ahead in both the crypto-native and traditional asset arenas.

The surge in capital has fueled demand for Ethena’s governance token ENA, which doubled in value over the last month. However, ENA pulled back 12% in the past 24 hours as investors await the activation of the platform’s fee distribution mechanism.

Ethena has already met most of the requirements needed to begin distributing revenue to ENA stakers. The final milestone — achieving a favorable yield spread compared to competitors — is expected to be reached soon.

A Self-Reinforcing Growth Engine

Ethena’s rise is powered by a reflexive mechanism embedded in its stablecoin model. As prices for bitcoin and ether rise, perpetual funding rates turn increasingly positive. Ethena captures these yields via delta-neutral hedges and redistributes them to sUSDe holders in real time.

This yield draw attracts more capital, prompting further issuance of USDe, more hedging, and greater protocol revenue — reinforcing the cycle.

In July alone, Ethena brought in nearly $50 million in protocol fees and $10 million in revenue, making it the sixth most profitable DeFi protocol last month, according to DeFiLlama.

ENA is currently trading at $0.58.

More Stories

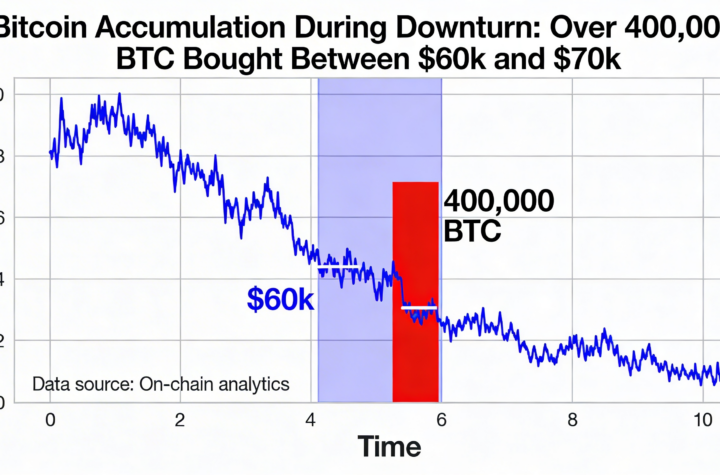

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

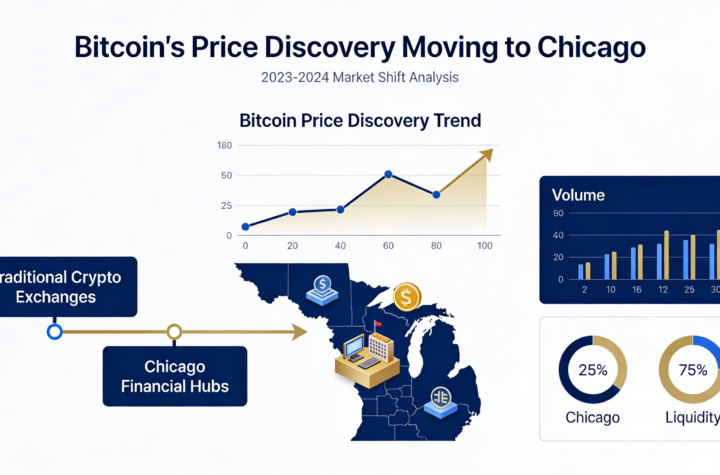

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago