Crypto Markets Whipsaw as Fed’s Powell Sparks $200M in Liquidations

Crypto markets swung sharply on Wednesday following Federal Reserve Chair Jerome Powell’s inflation warnings, triggering over $200 million in liquidations across digital assets in just one hour.

Bitcoin (BTC) briefly dipped below $116,000 during Powell’s press conference after the Fed opted to hold interest rates steady at 4.25%-4.5%. Despite the pause, Powell reiterated inflation risks tied to new tariffs, unsettling traders. Two Fed officials—Governors Bowman and Waller—dissented in favor of a rate cut, a rare split that added to market unease.

BTC later rebounded above $117,000 but remained down 0.8% on the day, still pinned near the lower end of its recent range. Ether (ETH) dropped as much as 3% before recovering to $3,750, down about 0.6% over 24 hours.

Altcoins bore the brunt of the volatility early in the session. Solana (SOL), Avalanche (AVAX), and Hyperliquid (HYPE) sank 4%-5% before trimming losses. BONK and PENGU plunged around 10% before staging partial recoveries.

Traditional equities, meanwhile, rallied after-hours on strong tech earnings. Meta (META) jumped 10%, and Microsoft (MSFT) rose 6% following better-than-expected quarterly results.

“The market increasingly believes the Fed is behind the curve,” said Matt Mena, analyst at 21Shares. He pointed to back-to-back soft inflation prints and signs of weakening consumer spending.

“With real yields still high and unemployment creeping up, holding this tight policy stance may tip the economy into a broader slowdown,” Mena warned.

He likened current conditions to late 2023, when political instability and cooling inflation forced the Fed to shift direction. “The setup is in place for a pivot—and that could push Bitcoin toward $150,000 by year-end,” he said.

More Stories

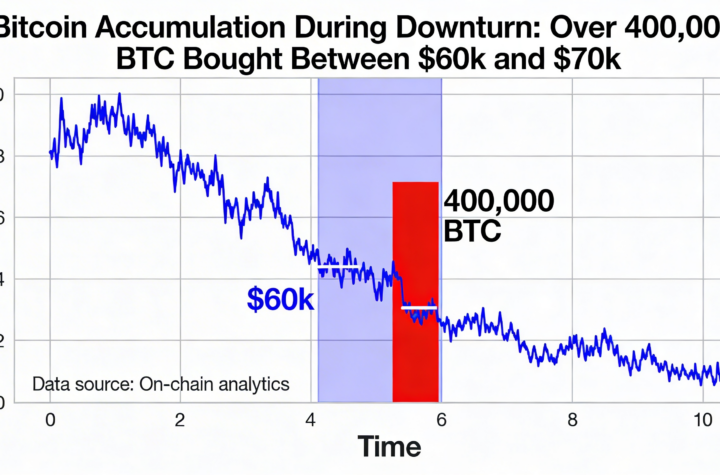

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

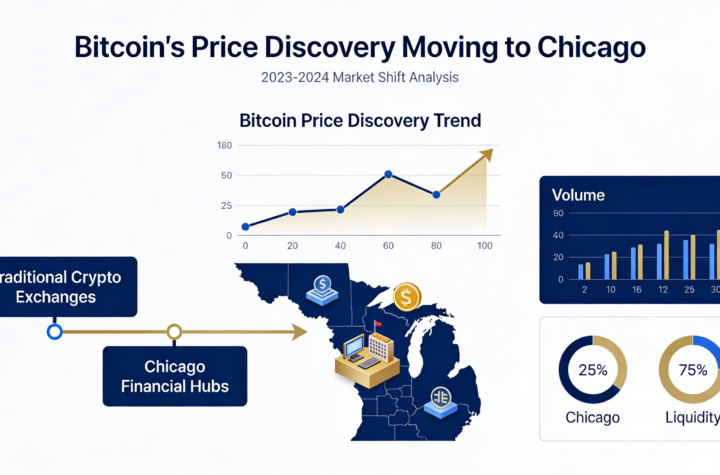

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago