Powell Flags Tariff-Driven Inflation Risks, Bitcoin Sinks on Hawkish Tone

Federal Reserve Chair Jerome Powell struck a defiant tone Wednesday, warning that rising tariffs from the Trump administration are fueling inflation and may force the central bank’s hand.

“Increased tariffs are pushing up prices,” Powell said during the post-meeting press conference. “Near-term inflation expectations have moved higher.”

The Fed kept interest rates unchanged at 4.25%–4.5%, in line with expectations. However, two Fed governors—Christopher Waller and Michelle Bowman—dissented, preferring a 25 basis point rate cut. It marked the first dual dissent since 1993.

Despite the hold, Powell gave no sign of shifting toward easier policy, even amid mounting political pressure from the White House. “You could say the Fed is looking through inflation by not hiking [rates],” he said, suggesting the door remains open for future tightening if inflation pressures worsen.

Markets sold off following Powell’s comments. Bitcoin (BTC) slid nearly 2% to $115,800, while U.S. equities reversed early gains. The Nasdaq and S&P 500 both slipped into negative territory. Altcoins saw deeper losses—ether (ETH), solana (SOL), and XRP each dropped about 4%.

While Powell acknowledged internal and political pressure for rate cuts, his stance reinforced the Fed’s commitment to price stability—even at the cost of near-term market volatility.

More Stories

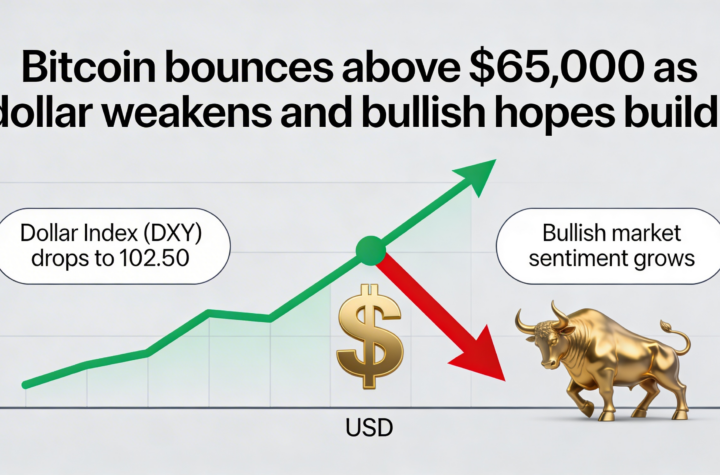

Bitcoin pushes past $65,000 as dollar strength fades and bullish sentiment strengthens.

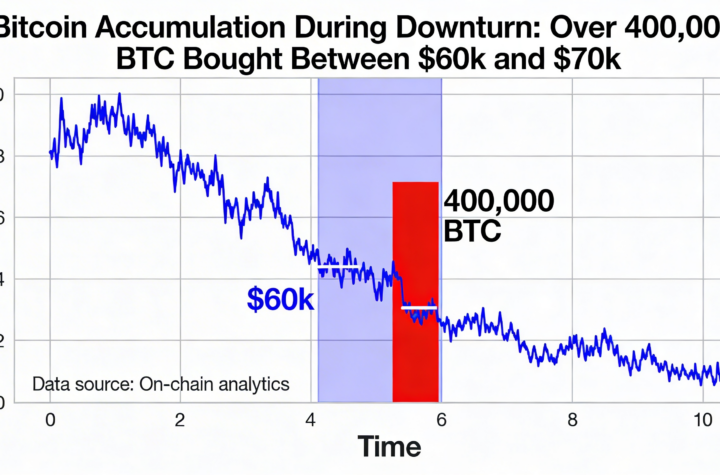

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone