Ethereum Eyes $15K as Institutional Momentum Builds, Says Fundstrat’s Tom Lee

Ethereum (ETH) is emerging as Wall Street’s top blockchain bet, with Fundstrat’s Tom Lee projecting a medium-term valuation of up to $15,000. Lee’s bullish thesis is grounded in accelerating stablecoin growth, real-world asset tokenization, and growing alignment with traditional finance.

On-chain data supports this optimism. According to crypto analyst Ali Martinez, Ethereum whales have accumulated over 500,000 ETH in the past two weeks — a trend often associated with upcoming price rallies or major developments within the network.

In a recent CoinDesk interview, Lee cited a valuation model by Fundstrat’s Head of Digital Asset Strategy, Sean Farrell, which compares Ethereum’s economic fundamentals to private tech firms like Circle. Applying EBITDA-based multiples, Farrell estimates ETH could be worth as much as $15,000.

Lee emphasized that platforms like Ethereum — which serve as foundational infrastructure for decentralized ecosystems — warrant premium valuations, akin to software companies compared to traditional consumer businesses.

Fundstrat’s Head of Technical Strategy, Mark Newton, added a near-term target, suggesting ETH could reach $4,000 before the end of July. Lee called that a first stop, with the $10,000–$15,000 range being realistic as network adoption and usage metrics accelerate. He also hinted that such a move could occur by year-end, if not earlier.

Ethereum’s institutional credibility continues to rise. Lee highlighted JPMorgan’s stablecoin project and Robinhood’s tokenization initiative — both built on Ethereum — as key endorsements. He noted that Ethereum currently hosts over 60% of all tokenized real-world assets (RWAs), a figure expected to climb further. If the stablecoin market surpasses $2 trillion, as predicted by Treasury Secretary Bessent, Ethereum could see exponential growth.

At 16:41 GMT on July 19, ETH was trading at $3,564.10, down 0.26% on the day, per CoinDesk.

Technical Analysis Highlights

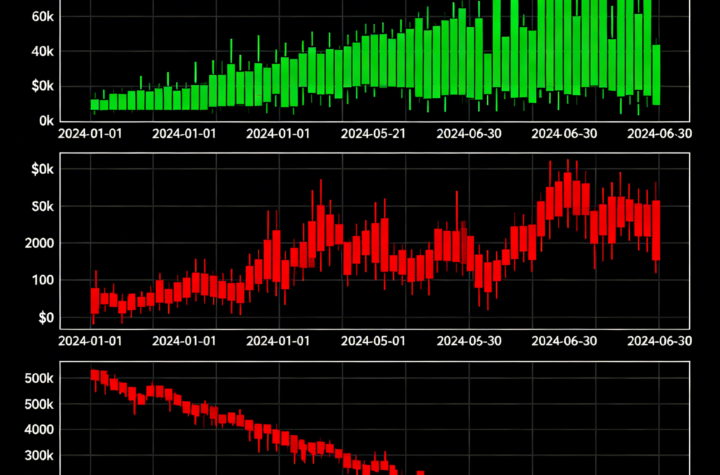

- Range & Volatility: ETH traded between $3,670.26 and $3,480.58 from July 18 at 13:00 UTC to July 19 at 12:00 UTC — a 5% intraday swing.

- Selloff & Recovery: The sharpest drop came between 14:00 and 20:00 UTC on July 18, with heavy volume peaking at 830,808 units.

- Key Levels: Resistance formed near $3,670; support held around $3,480.

- Consolidation Phase: ETH entered a holding pattern between $3,540 and $3,600 as volume declined — a signal of waning sell pressure.

- Late Bounce: ETH rebounded from $3,546 to $3,558 in the final hour of trading on July 19, with increased volume suggesting fresh institutional accumulation.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%