BlackRock is aiming to bring staking to its iShares Ethereum Trust (ETHA), signaling a major evolution in the landscape of spot crypto ETFs.

In a revised 19b-4 filing submitted by Nasdaq on Thursday, the asset management giant proposed an amendment that would allow ETHA to participate in Ethereum staking. If approved, this would enable the trust to earn rewards by helping validate transactions on the Ethereum network—potentially making ETHA the first U.S.-listed spot ether ETF to incorporate staking.

The move comes as multiple issuers push for similar permissions, with firms like Grayscale and Franklin Templeton also seeking to integrate staking into their Ethereum products. Though the SEC has not yet approved any staking-enabled ETFs, BlackRock’s submission suggests growing optimism that such strategies could soon gain regulatory acceptance.

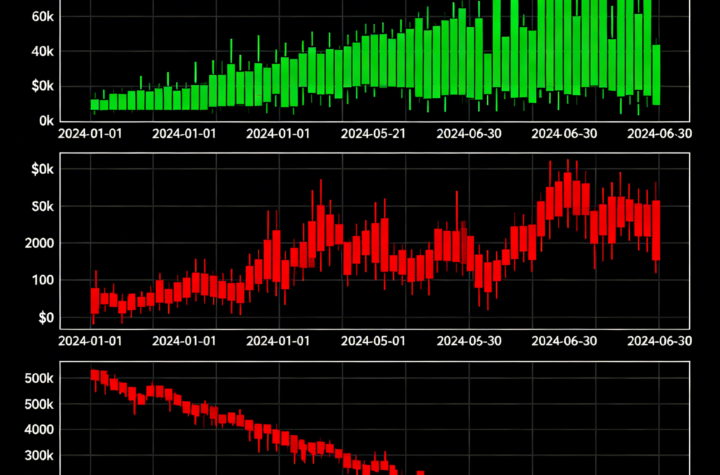

ETHA, launched in June 2024, has rapidly grown to over $7.2 billion in assets under management. Shares of the fund closed at $25.42 on Thursday.

Staking would give ETHA a competitive edge by aligning its structure with how many ETH holders already earn passive income directly on-chain. It would also allow traditional investors to access staking yields without needing to interact with crypto infrastructure themselves.

If approved, BlackRock’s move could pave the way for a new generation of crypto ETFs that combine price exposure with yield potential—marking a turning point in institutional Ethereum adoption.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%